Valid Owner Financing Contract Template

In the realm of real estate transactions, an innovative approach that has garnered attention is owner financing. This method serves as an alternative to traditional bank lending, providing buyers and sellers with a unique set of opportunities and challenges. At the heart of this financing model lies the Owner Financing Contract form, a critical document that outlines the terms and conditions agreed upon by both parties. It covers crucial aspects such as the sale price, interest rate, repayment schedule, and the rights and responsibilities of each party. Moreover, this contract form is tailored to ensure compliance with legal standards, hence safeguarding both the seller's and the buyer's interests. Equally important, this form paves the way for buyers who may not qualify for traditional financing options to achieve homeownership, while offering sellers a faster closing process and potential tax advantages. However, navigating through the intricacies of this agreement demands a clear understanding of its components, due diligence from both parties, and, oftentimes, the guidance of a professional well-versed in the legalities of real estate transactions.

Sample - Owner Financing Contract Form

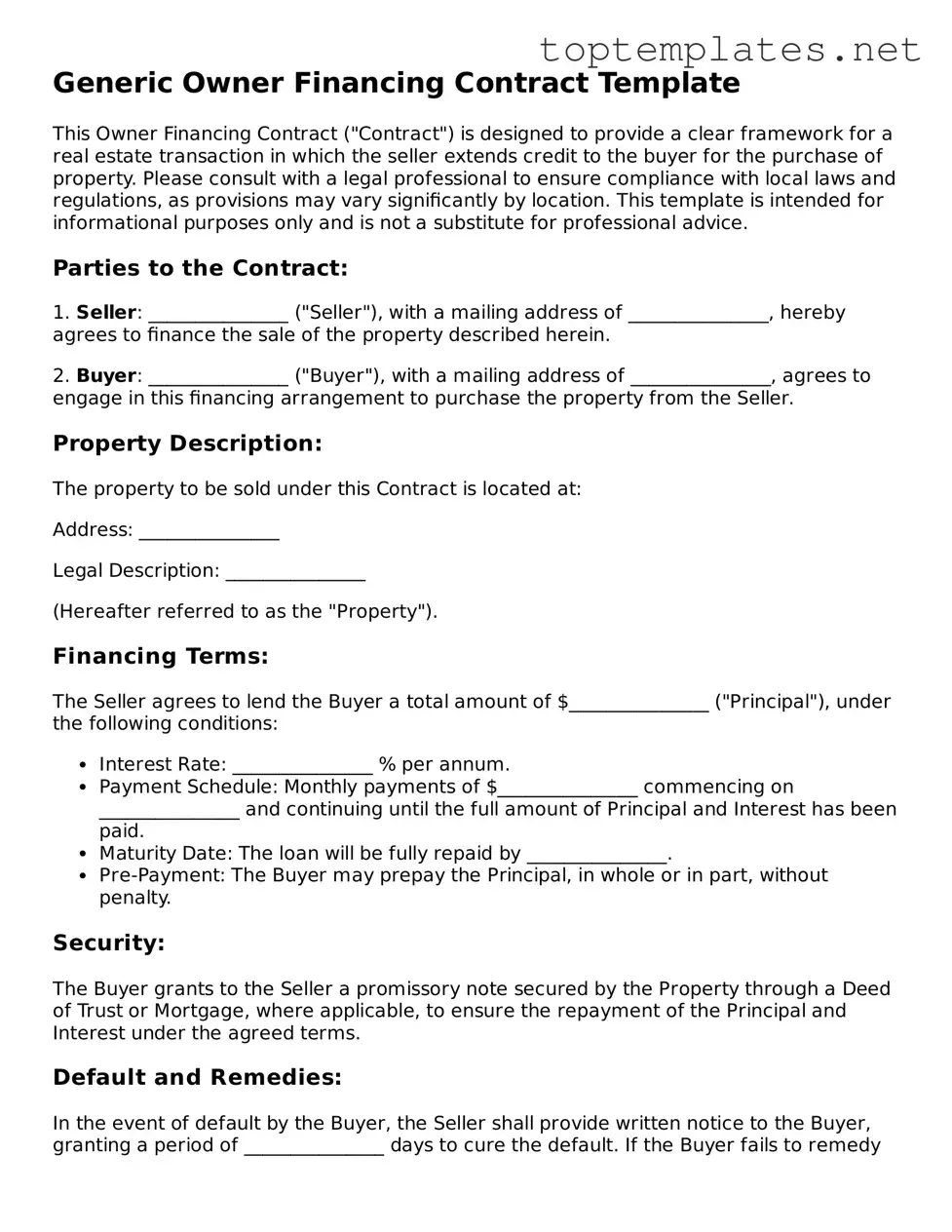

Generic Owner Financing Contract Template

This Owner Financing Contract ("Contract") is designed to provide a clear framework for a real estate transaction in which the seller extends credit to the buyer for the purchase of property. Please consult with a legal professional to ensure compliance with local laws and regulations, as provisions may vary significantly by location. This template is intended for informational purposes only and is not a substitute for professional advice.

Parties to the Contract:

1. Seller: _______________ ("Seller"), with a mailing address of _______________, hereby agrees to finance the sale of the property described herein.

2. Buyer: _______________ ("Buyer"), with a mailing address of _______________, agrees to engage in this financing arrangement to purchase the property from the Seller.

Property Description:

The property to be sold under this Contract is located at:

Address: _______________

Legal Description: _______________

(Hereafter referred to as the "Property").

Financing Terms:

The Seller agrees to lend the Buyer a total amount of $_______________ ("Principal"), under the following conditions:

- Interest Rate: _______________ % per annum.

- Payment Schedule: Monthly payments of $_______________ commencing on _______________ and continuing until the full amount of Principal and Interest has been paid.

- Maturity Date: The loan will be fully repaid by _______________.

- Pre-Payment: The Buyer may prepay the Principal, in whole or in part, without penalty.

Security:

The Buyer grants to the Seller a promissory note secured by the Property through a Deed of Trust or Mortgage, where applicable, to ensure the repayment of the Principal and Interest under the agreed terms.

Default and Remedies:

In the event of default by the Buyer, the Seller shall provide written notice to the Buyer, granting a period of _______________ days to cure the default. If the Buyer fails to remedy the default within this period, the Seller may exercise legal remedies, including but not limited to foreclosure proceedings in accordance with state laws.

Governing Law:

This Contract shall be governed by and construed in accordance with the laws of the State of _______________.

Signatures:

This Contract shall be effective upon the signatures of both parties:

Seller's Signature: _______________ Date: _______________

Buyer's Signature: _______________ Date: _______________

This template is provided as a starting point. It's strongly recommended to consult with a legal professional to customize this document to fit the specifics of your transaction and to ensure compliance with state-specific laws and regulations.

File Breakdown

| Fact Name | Detail |

|---|---|

| Definition | Owner Financing Contract forms are agreements where the seller of a property provides the mortgage to the buyer, essentially acting as the lender. |

| Buyer Benefits | Buyers can often secure financing more easily and may negotiate better terms directly with the seller. |

| Seller Benefits | Sellers can make their property more attractive to potential buyers and may receive a steady income stream from the loan payments. |

| Interest Rates | Interest rates in Owner Financing Contracts can sometimes be higher than traditional bank rates to compensate the seller for credit risks. |

| Down Payment | A significant down payment is usually required in owner financing to protect the seller’s interests. |

| Loan Terms | The terms of the loan, including interest rate, down payment, and length of the loan, are negotiable between buyer and seller. |

| Governing Laws | The contract is governed by state laws, which vary widely, so it's essential to consult local statutes for specific regulations. |

| Risks for Sellers | Sellers risk default by the buyer, which could necessitate a foreclosure process to reclaim the property. |

| Risks for Buyers | Buyers risk losing their investment if they default on the loan, similar to a traditional mortgage. |

Steps to Filling Out Owner Financing Contract

When entering into a financial agreement related to property, an Owner Financing Contract is pivotal. This document outlines the terms under which the seller of the property provides financing to the buyer, bypassing traditional lending institutions. Completing this form accurately is essential to ensure both parties are protected and understand their responsibilities and rights under the agreement. The following steps will guide you through the necessary parts of the form, ensuring you fill it out comprehensively and correctly.

- Start by providing the date at the top of the form. This indicates when the agreement takes effect.

- Enter the full legal names of both the buyer and seller in the designated areas. Make sure to double-check the spelling and inclusion of any middle names or initials to ensure legal accuracy.

- Fill in the property details, including its address, legal description, and any identifying parcel numbers. This information should match what's on the property's official records to avoid discrepancies.

- Specify the sale price of the property in the section provided. Also, detail the amount of the down payment and the remaining balance that will be financed through this owner financing agreement.

- List the interest rate, calculated annually, that will apply to the financed amount. This should be a negotiated rate that is fair and in accordance with state laws.

- Describe the payment schedule, including the monthly payment amount, due dates, and the term of the loan (e.g., 15 years, 30 years). Clearly outline any grace periods or penalties for late payments as well.

- Detail any prepayment penalties or the lack thereof. This section should explain if the buyer is penalized for paying the balance early.

- Include clauses on default and foreclosure procedures. It is crucial to define the circumstances under which the seller can declare the buyer in default and the steps for foreclosure, if necessary.

- State any special conditions or contingencies that might apply to the agreement. These can include requirements for insurance, maintenance agreements, or other conditions specific to the property.

- Have both parties sign and date the form at the bottom, possibly in the presence of a notary public to provide additional legal validation to the document.

After completing the Owner Financing Contract form, both parties should review the document together to confirm all the information is accurate and reflects their agreement. It's advised to keep copies of the contract in a safe but accessible location. For further safety, consider consulting with a legal professional to review the document before finalization. This extra step ensures that the contract abides by all relevant laws and fully protects the interests of both the buyer and seller.

Discover More on Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legally binding agreement between a seller and a buyer in which the seller provides the financing for the purchase of the property. Instead of the buyer obtaining a loan from a bank, the seller offers to finance the purchase themselves. This type of contract specifies the terms of the loan, including interest rate, repayment schedule, and what happens if the buyer defaults on the loan.

How does an Owner Financing Contract differ from a traditional mortgage?

Unlike a traditional mortgage, where the buyer secures financing through a bank or another lending institution, an Owner Financing Contract means the seller plays the role of the lender. The main difference lies in who provides the loan. It allows for more flexible terms, such as negotiating the interest rate and payment schedule directly between the buyer and seller. However, similar responsibilities like property insurance and taxes still fall on the buyer, akin to a traditional mortgage.

What are the benefits of using an Owner Financing Contract?

For buyers, the benefits include potentially less stringent qualification criteria, faster closing processes, and the possibility of negotiating more favorable terms. Sellers can benefit by opening up their property to a broader market of buyers who may not qualify for traditional financing, possibly selling the property faster, and earning interest on the loan provided to the buyer.

Are there any risks involved in an Owner Financing Contract?

Yes, there are risks for both the seller and the buyer. The seller takes on the risk that the buyer may default on the loan, potentially leading to a lengthy and costly foreclosure process. For the buyer, there's the risk that if they default, they will lose not only the property but also any equity they have built up. Both parties should carefully weigh these risks and consider consulting with a real estate attorney to structure the contract beneficially and securely.

What should be included in an Owner Financing Contract?

Key elements include the purchase price, down payment, interest rate, payment schedule, default consequences, and any other agreed-upon terms such as who handles property taxes, insurance, and maintenance. It's crucial for both parties to clearly understand and agree upon these terms to avoid future disputes.

Can an Owner Financing Contract be modified or refinanced?

Yes, it is possible to modify or refinance an Owner Financing Contract, but any changes to the original terms must be agreed upon by both the seller and the buyer. Refinancing through a traditional lender may also be an option for the buyer, especially if their financial situation has improved since the original purchase. Any modification or refinancing should be done with proper documentation to protect both parties' interests.

Common mistakes

When individuals venture into the domain of owner financing, the Owner Financing Contract becomes a pivotal document. This contract outlines the terms and conditions agreed upon between the buyer and the seller when the seller provides the financing for the buyer's purchase of the property. However, the complexity and significance of this contract often lead to errors during its formulation. Recognizing and avoiding these mistakes can prevent future disputes and ensure a smoother transaction.

-

Not Clearly Defining the Terms of the Loan: One of the most critical aspects of an Owner Financing Contract is the detailed explanation of the loan's terms, including the interest rate, payment schedule, and the duration of the loan. Failure to specify these elements can lead to ambiguity and potential legal complications.

-

Omitting Legal Descriptions of the Property: Another common mistake is not providing a comprehensive legal description of the property being purchased. This description is crucial because it precisely identifies the property subject to the financing agreement, differentiating it from any other.

-

Ignoring the Need for a Down Payment: Often, parties neglect to discuss or include the terms regarding a down payment in the contract. A down payment not only provides security for the seller but also demonstrates the buyer's commitment to maintaining the terms of the financing.

-

Forgetting to Include Consequences for Default: The contract should always outline the repercussions for the buyer if they default on their payments. This includes specifying any grace periods, and the rights the seller has, such as initiating foreclosure proceedings.

-

Failure to Address Insurance and Taxes: A comprehensive Owner Financing Contract must delineate who is responsible for property taxes, insurance, and maintenance. Without explicit terms, disputes over these financial obligations can arise, potentially leading to litigation.

-

Lack of Clause on Sale or Transfer by Buyer: It’s essential to consider whether the buyer can sell or otherwise transfer their interest in the property and under what conditions. Without a clause addressing this, the seller might find the property in the hands of someone they have not vetted or approved.

By addressing these areas thoroughly, both parties can protect their interests and ensure that the agreement reflects their understanding and intentions. It is advisable for individuals to consult with legal professionals to tailor the Owner Financing Contract to their specific needs, ensuring all legal requirements are met and potential pitfalls are avoided.

Documents used along the form

When navigating the process of purchasing a home through owner financing, the Owner Financing Contract is a crucial document that outlines the terms of the agreement between the buyer and the seller. However, to ensure a smooth and legally sound transaction, other forms and documents are often required in addition to this contract. These documents help protect the interests of both parties and provide a clear framework for the ownership transition. Below is a list of four commonly used documents in conjunction with the Owner Financing Contract.

- Promissory Note: This document is a detailed record of the loan’s terms provided by the seller to the buyer. It includes important information such as the interest rate, repayment schedule, and the consequences of defaulting on the loan. Essentially, it formalizes the buyer's promise to repay the borrowed amount.

- Amortization Schedule: Accompanying the promissory note, this schedule outlines each payment throughout the loan's lifetime. It shows how payments are split between interest and principal, illustrating how the loan balance decreases over time.

- Property Deed with Vendor’s Lien: This deed transfers ownership of the property from the seller to the buyer but includes a vendor’s lien that gives the seller a claim against the property until the buyer fulfills all contract terms, including complete payment. This ensures the seller’s interest is protected if the buyer defaults.

- Title Report: Before finalizing the owner financing agreement, a title report is essential to confirm the legal ownership of the seller and to identify any claims or liens against the property. Ensuring the property has a clear title is crucial for the transaction's legality and the buyer's protection.

While the Owner Financing Contract is the foundation of the agreement between buyer and seller, the additional documents listed above are equally important to ensure clarity, legality, and peace of mind for both parties involved. Properly preparing and understanding these documents can significantly contribute to a successful and fair owner-financed transaction.

Similar forms

Promissory Note: Just like an owner financing contract, a promissory note is a crucial document between two parties. It details the borrower's promise to pay back a sum of money to the lender. This document usually specifies terms including the loan amount, interest rate, payment schedule, and the consequences of non-payment, which are key elements often outlined in owner financing contracts as well.

Mortgage Agreement: The mortgage agreement shares similarities with an owner financing contract by securing a loan with the property itself. In both cases, the document serves as a legal agreement that puts a lien on the property as collateral for the loan. If the borrower fails to fulfill the payment obligations, the lender (or seller, in the case of an owner financing contract) can foreclose on the property to recoup their investment.

Deed of Trust: Similarly, a deed of trust involves three parties: the borrower, the lender, and a trustee, and is used in some states in place of a mortgage agreement. Like an owner financing contract, it places a lien on the property and outlines conditions under which the property can be foreclosed upon and sold if the borrower defaults on the loan.

Land Sale Contract: This contract is specifically focused on the sale and purchase of land rather than a built property. An owner financing contract can sometimes be a type of land sale contract when it involves the sale of a parcel of land with financing terms directly from the seller. Both documents will detail the agreement’s terms, including payment schedule, interest rates, and the responsibilities of both parties.

Lease-Purchase Agreement: Lease-purchase agreements are another form of owner financing but geared towards leasing. They allow the renter to lease the property with an option to buy, typically within a specified period at a predetermined price. Like owner financing contracts, they make it possible for buyers to work toward ownership over time, including terms regarding payments, upkeep responsibilities, and the transfer of title.

Real Estate Purchase Agreement: This is a broad agreement that outlines the terms and conditions of a property sale between a buyer and a seller. While it can exist independently of any financing arrangements, when an owner financing contract is used, aspects of the real estate purchase agreement are integrated with financing terms to create a comprehensive sales and financing document outlining the parties’ rights, responsibilities, and obligations.

Dos and Don'ts

When filling out the Owner Financing Contract form, it's crucial to approach the task with diligence and accuracy. The following guidelines will help ensure that the process is carried out correctly, minimizing the potential for errors and misinterpretations.

- Do ensure all information is accurate: Double-check facts such as the property address, buyer and seller names, and the financial terms to prevent any discrepancies.

- Don't rush through the process: Take your time to read through each section carefully, ensuring you fully understand the terms before providing your information.

- Do check for compliance with local laws: Ownership financing laws can differ significantly from one location to another. Ensure your contract is compliant with local regulations to avoid legal issues.

- Don't leave any fields blank: If a section does not apply, mark it as "N/A" or "Not Applicable" rather than leaving it empty. This shows that you have reviewed the section and confirmed it does not apply to your situation.

- Do use clear and precise language: Avoid using technical jargon or ambiguous terms. The contract should be understandable to all parties involved, regardless of their legal knowledge.

- Don't sign without reviewing: Before signing the contract, make sure that all the information is correct and that you fully understand the commitment you are making. If necessary, consult with a legal professional.

- Do keep a copy for your records: After the contract has been filled out and signed by all parties, ensure you keep a copy in a safe place. This document will be important for future reference.

- Don't forget to witness and notarize the contract: Having the contract witnessed and notarized can add an extra layer of legality and authenticity, making it more enforceable in a court of law.

Misconceptions

When entering into an owner financing contract, parties often come with preconceived notions that may not align with reality. Understanding these misconceptions can pave the way for a smoother transaction and relationship between the buyer and seller. Below are seven common misconceptions about the Owner Financing Contract form.

It Only Benefits the Buyer: Many believe that owner financing exclusively benefits the buyer, when in fact, it also offers significant advantages to the seller, including potential tax breaks and the ability to sell the property as-is.

Legal Assistance Is Not Required: Another common misconception is that the process is so straightforward that legal advice or assistance isn't necessary. However, having a legal professional review the contract can prevent future disputes and ensure that the agreement complies with state and federal laws.

It Eliminates the Need for a Down Payment: People often think that owner financing means the buyer won't need to make a down payment. While it's true that terms are flexible, most sellers will still require some form of down payment to protect their investment.

Interest Rates Are Non-Negotiable: Unlike traditional bank loans, the interest rates in an owner financing contract are fully negotiable between the buyer and seller. This flexibility is a significant advantage of owner financing.

Owner Financing Is Only for Buyers with Poor Credit: While it's true that owner financing can be an excellent option for individuals with less-than-perfect credit, it's also beneficial for buyers who seek a faster closing process or wish to avoid traditional financing's red tape.

The Seller Assumes All the Risk: The belief that the seller carries all the risk overlooks the protections put in place within the contract. With properly structured agreements, risks can be significantly minimized or shared between the parties.

There Is Only One Standard Contract Form: Finally, a common misconception is that there is a one-size-fits-all contract for owner financing. In reality, the contract should be customized to fit the specific terms agreed upon by the buyer and seller, reflecting the unique aspects of their deal.

Understanding the nuances of an Owner Financing Contract can help both parties navigate the process more effectively, ensuring a fair and beneficial agreement is reached. It's crucial to approach such transactions with an open mind and due diligence to mitigate any potential misunderstandings or disappointments.

Key takeaways

When engaging with an Owner Financing Contract, individuals enter into a unique arrangement that allows the buyer to purchase property directly from the seller without the need for a traditional mortgage loan from a financial institution. Understanding the intricacies of this agreement is crucial for both parties to ensure a fair and legally binding transaction. Below are key takeaways about filling out and using the Owner Financing Contract form:

- Accuracy is key: Every detail in the contract must be accurate and thoroughly checked. This includes the names of the buyer and seller, the description of the property, the sale price, and the terms of the financing. Any inaccuracies can lead to disputes or legal complications down the road.

- Define the terms: Clearly state the financing terms, including the interest rate, repayment schedule, term of the loan, and any balloon payments or penalties for late payment. Clear terms prevent misunderstandings that could affect the relationship between the buyer and seller.

- Legal requirements: The contract must comply with state and local laws, which can vary widely. These may dictate the legal language required in the contract, specific disclosures, and other terms that must be included to protect both parties. It may be necessary to consult with a legal professional to ensure compliance.

- Right to Sell: The seller must legally have the right to sell the property. This means that the property should not be encumbered by liens or other claims that would prevent the transfer of a clear title to the buyer. Verification through a title search is recommended.

- Record the contract: Once signed, the contract should be recorded with the local county recorder's office. This official recording serves as public notice of the buyer's interest in the property and helps protect that interest against claims by third parties.

Adhering to these key points can significantly smooth the process of filling out and using an Owner Financing Contract. While this method of financing can provide opportunities that traditional mortgages cannot, the importance of due diligence and legal compliance cannot be overstressed. Both buyer and seller should consider professional advice to ensure their interests are fully protected.

Find Other Types of Owner Financing Contract Documents

Purchase Agreement Addendum - It can serve to clarify ambiguities or conflicting terms in the initial agreement.