Free Sample Tax Return Transcript PDF Form

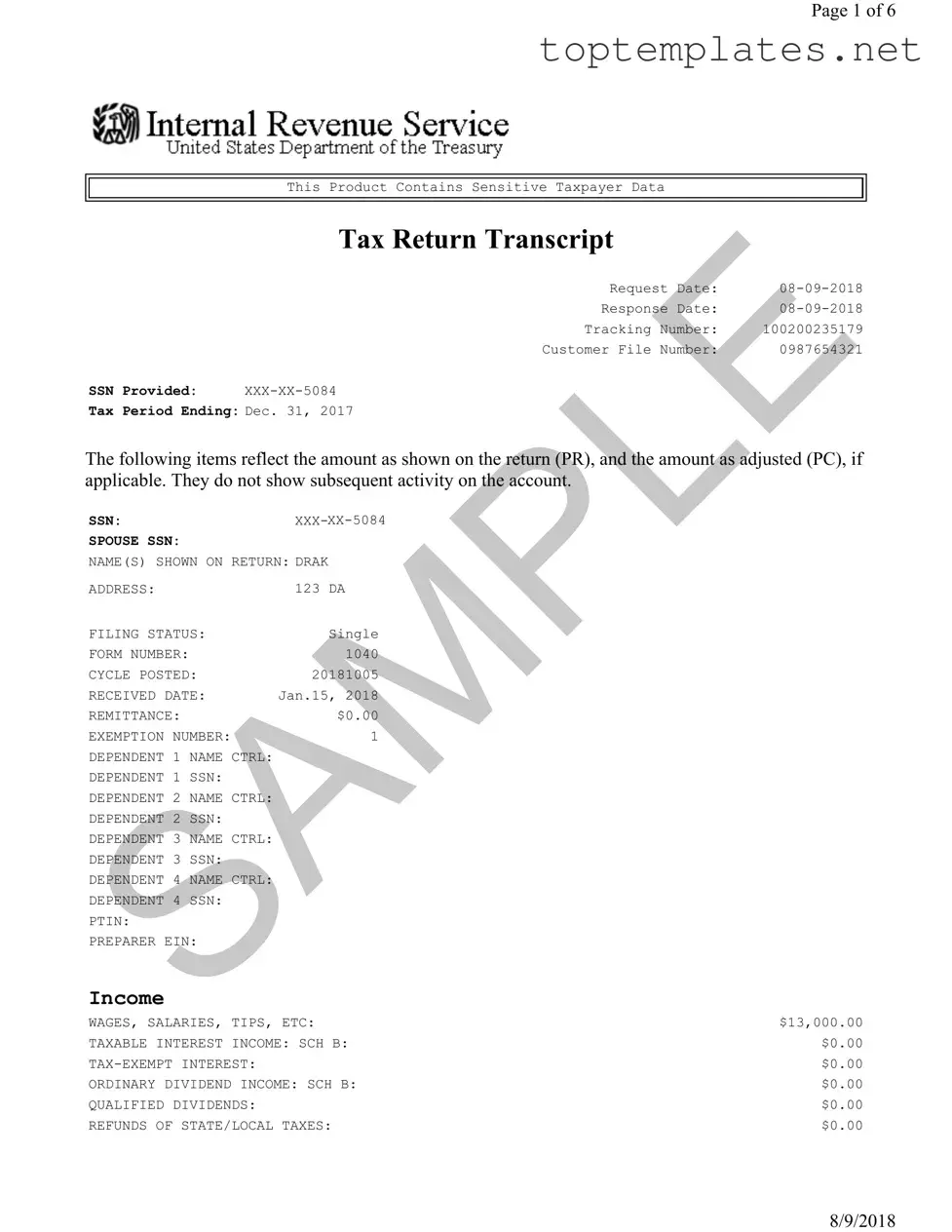

Grasping the essentials and complexities of the Sample Tax Return Transcript form requires a deep dive into its numerous components, meticulously structured over six informative pages. With its initial request dated August 9, 2018, this document offers a transparent view into the individual tax return details for the year ending December 31, 2017. It not only highlights taxpayer identity, including a partially redacted Social Security Number (SSN), filing status, and contact details but also meticulously breaks down the financial figures into categories of income, adjustments, taxes, and credits. The form meticulously enumerates earnings from various sources like wages, business income, and any possible adjustments due to expenses or deductions. Furthermore, it extends into tax calculations, showcasing any applied credits and the final assessment of taxes owed or refundable, alongside a section dedicated to payments that covers withholdings and other credits. Notably, the form also furnishes details on other taxes and potential amounts due, such as self-employment tax and the unpaid FICA on reported tips, culminating in a detailed financial picture for the tax period in question. Each section methodically contrasts the initially reported amounts with those calculated or adjusted by the computer, ensuring precision in the tax return's assessment. This intricate breakdown not only aids in financial planning and analysis for the taxpayer but also serves as a crucial tool for audit and verification purposes, highlighting the form's multifaceted utility.

Sample - Sample Tax Return Transcript Form

Page 1 of 6

This Product Contains Sensitive Taxpayer Data

Tax Return Transcript

|

Request Date: |

|

|

Response Date: |

|

|

Tracking Number: |

100200235179 |

|

Customer File Number: |

0987654321 |

SSN Provided: |

|

Tax Period Ending: Dec. 31, 2017

The following items reflect the amount as shown on the return (PR), and the amount as adjusted (PC), if applicable. They do not show subsequent activity on the account.

SSN: |

|

|

SPOUSE SSN: |

|

|

NAME(S) SHOWN ON RETURN: DRAK |

||

ADDRESS: |

|

123 DA |

FILING STATUS: |

Single |

|

FORM NUMBER: |

|

1040 |

CYCLE POSTED: |

20181005 |

|

RECEIVED DATE: |

Jan.15, 2018 |

|

REMITTANCE: |

|

$0.00 |

EXEMPTION NUMBER: |

1 |

|

DEPENDENT 1 |

N ME CTRL: |

|

DEPENDENT 1 |

SSN: |

|

DEPENDENT 2 |

N ME CTRL: |

|

DEPENDENT 2 |

SSN: |

|

DEPENDENT 3 |

N ME CTRL: |

|

DEPENDENT 3 |

N: |

|

DEPENDENT 4 |

N ME CTRL: |

|

DEPENDENT 4 |

N: |

|

PTIN: |

|

|

PREPARER EIN: |

|

|

Income

WAGES, SALARIES, TIPS, ETC: |

$13,000.00 |

TAXABLE INTEREST INCOME: SCH B: |

$0.00 |

$0.00 |

|

ORDINARY DIVIDEND INCOME: SCH B: |

$0.00 |

QUALIFIED DIVIDENDS: |

$0.00 |

REFUNDS OF STATE/LOCAL TAXES: |

$0.00 |

8/9/2018

Page 2 of 6

ALIMONY RECEIVED: |

|

$0.00 |

BUSINESS INCOME OR LOSS (Schedule C): |

|

$2,500.00 |

BUSINESS INCOME OR LOSS: SCH C PER COMPUTER: |

|

$2,500.00 |

CAPITAL GAIN OR LOSS: (Schedule D): |

|

$0.00 |

CAPITAL GAINS OR LOSS: SCH D PER COMPUTER: |

|

$0.00 |

OTHER GAINS OR LOSSES (Form 4797): |

|

$0.00 |

TOTAL IRA DISTRIBUTIONS: |

|

$0.00 |

TAXABLE IRA DISTRIBUTIONS: |

|

$0.00 |

TOTAL PENSIONS AND ANNUITIES: |

|

$0.00 |

SAMPLE |

$0.00 |

|

TAXABLE PENSION/ANNUITY AMOUNT: |

|

|

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E): |

|

$0.00 |

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E) PER COMPUTER: |

|

$0.00 |

RENT/ROYALTY INCOME/LOSS PER COMPUTER: |

|

$0.00 |

ESTATE/TRUST INCOME/LOSS PER COMPUTER: |

|

$0.00 |

|

$0.00 |

|

FARM INCOME OR LOSS (Schedule F): |

|

$0.00 |

FARM INCOME OR LOSS (Schedule F) PER COMPUTER: |

|

$0.00 |

UNEMPLOYMENT COMPENSATION: |

|

$0.00 |

TOTAL SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS PER COM UTER: |

|

$0.00 |

OTHER INCOME: |

|

$0.00 |

SCHEDULE EIC SE INCOME PER COMPUTER: |

|

$2,323.00 |

SCHEDULE EIC EARNED INCOME PER COMPUTER: |

$15,323.00 |

|

SCH EIC DISQUALIFIED INC COMPUTER: |

|

$0.00 |

TOTAL INCOME: |

$15,500.00 |

|

TOTAL INCOME PER COMPUTER: |

$15,500.00 |

|

Adjustments to Income

EDUCATOR EXPENSES: |

|

$0.00 |

||

EDUCATOR EXPENSES PER CO PUTER: |

$0.00 |

|||

RESERVIST AND OTHER |

BUSINESS EXPENSE: |

$0.00 |

||

HEALTH |

VINGS |

CCT |

DEDUCTION: |

$0.00 |

HEALTH S VINGS |

CCT |

DEDUCTION PER CO PTR: |

$0.00 |

|

MOVING EXPENSES: F3903: |

$0.00 |

|||

SELF EMPLOYMENT T X DEDUCTION: |

$177.00 |

|||

SELF EMPLOYMENT T X DEDUCTION PER COMPUTER: |

$177.00 |

|||

ELF EMPLOYMENT T X DEDUCTION VERIFIED: |

$0.00 |

|||

KEOGH/ EP CONTRIBUTION DEDUCTION: |

$0.00 |

|||

$0.00 |

||||

EARLY WITHDRAWAL OF |

AVINGS PENALTY: |

$0.00 |

||

ALIMONY PAID |

N: |

|

|

|

ALIMONY PAID: |

|

|

$0.00 |

|

IRA DEDUCTION: |

|

|

$0.00 |

|

IRA DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION VERIFIED: |

$0.00 |

|||

TUITION AND FEES DEDUCTION: |

$0.00 |

|||

TUITION AND FEES DEDUCTION PER COMPUTER: |

$0.00 |

|||

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION: |

$0.00 |

|||

8/9/2018

Page 3 of 6

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

OTHER ADJUSTMENTS: |

|

|

$0.00 |

||

ARCHER MSA DEDUCTION: |

|

$0.00 |

|||

ARCHER MSA DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TOTAL ADJUSTMENTS: |

|

|

$177.00 |

||

TOTAL ADJUSTMENTS PER COMPUTER: |

|

$177.00 |

|||

ADJUSTED GROSS INCOME: |

$15,323.00 |

||||

ADJUSTED GROSS INCOME PER COMPUTER: |

$15,323.00 |

||||

SAMPLE |

|

||||

Tax and Credits |

|

|

|||

|

|

NO |

|||

BLIND: |

|

|

|

|

NO |

SPOUSE |

|

|

NO |

||

SPOUSE BLIND: |

|

|

NO |

||

STANDARD DEDUCTION PER COMPUTER: |

|

$4,850.00 |

|||

ADDITIONAL STANDARD DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TAX TABLE INCOME PER COMPUTER: |

$10,473.00 |

||||

EXEMPTION AMOUNT PER COMPUTER: |

|

$3,100.00 |

|||

TAXABLE INCOME: |

|

|

$7,373.00 |

||

TAXABLE INCOME PER COMPUTER: |

|

$7,373.00 |

|||

TOTAL POSITIVE INCOME PER COMPUTER: |

$15,500.00 |

||||

TENTATIVE TAX: |

|

|

$749.00 |

||

TENTATIVE TAX PER COMPUTER: |

|

$749.00 |

|||

FORM 8814 ADDITIONAL TAX AMOUNT: |

|

$0.00 |

|||

TAX ON INCOME LESS SOC SEC INCOME PER COM UTER: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE MINIMUM TAX: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE INI UM TAX PER CO UTER: |

|

$0.00 |

|||

FOREIGN TAX CREDIT: |

|

$0.00 |

|||

FOREIGN TAX CREDIT PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION TAX PER CO PUTER: |

|

$0.00 |

|||

EXCESS ADVANCE PREMIUM TAX CREDIT REPAY ENT OUNT: |

|

$0.00 |

|||

EXCESS |

DV NCE PREMIUM T X CREDIT REP Y ENT VERIFIED A OUNT: |

|

$0.00 |

||

CHILD & DEPENDENT C RE CREDIT: |

|

$0.00 |

|||

CHILD & DEPENDENT C RE CREDIT PER COMPUTER: |

|

$0.00 |

|||

CREDIT FOR ELDERLY |

ND DIS BLED: |

|

$0.00 |

||

CREDIT FOR ELDERLY |

ND DIS BLED PER COMPUTER: |

|

$0.00 |

||

EDUCATION CREDIT: |

|

|

$0.00 |

||

EDUCATION CREDIT PER COMPUTER: |

|

$0.00 |

|||

GRO EDUC TION CREDIT PER COMPUTER: |

|

$0.00 |

|||

RETIREMENT |

AVINGS CNTRB CREDIT: |

|

$0.00 |

||

RETIREMENT |

AVINGS CNTRB CREDIT PER COMPUTER: |

|

$0.00 |

||

PRIM RET |

|

AV CNTRB: F8880 LN6A: |

|

$0.00 |

|

EC RET |

AV CNTRB: F8880 LN6B: |

|

$0.00 |

||

TOTAL RETIREMENT |

AVINGS CONTRIBUTION: F8880 CMPTR: |

|

$0.00 |

||

RESIDENTIAL ENERGY CREDIT: |

|

$0.00 |

|||

RESIDENTIAL ENERGY CREDIT PER COMPUTER: |

|

$0.00 |

|||

CHILD TAX CREDIT: |

|

|

$0.00 |

||

CHILD TAX CREDIT PER COMPUTER: |

|

$0.00 |

|||

ADOPTION CREDIT: F8839: |

|

$0.00 |

|||

ADOPTION CREDIT PER COMPUTER: |

|

$0.00 |

|||

8/9/2018

Page 4 of 6

FORM 8396 MORTGAGE CERTIFICATE CREDIT: |

$0.00 |

|

FORM 8396 MORTGAGE CERTIFICATE CREDIT PER COMPUTER: |

$0.00 |

|

F3800, F8801 AND OTHER CREDIT AMOUNT: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS PER COMPUTER: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801 PER COMPUTER: |

$0.00 |

|

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT AMOUNT: |

$0.00 |

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

SAMPLE |

$0.00 |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT AMOUNT: |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

OTHER CREDITS: |

$0.00 |

|

TOTAL CREDITS: |

$0.00 |

|

TOTAL CREDITS PER COMPUTER: |

$0.00 |

|

INCOME TAX AFTER CREDITS PER COMPUTER: |

$749.00 |

|

Other Taxes

SE TAX: |

|

$354.00 |

SE TAX PER COMPUTER: |

|

$354.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS: |

|

$0.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNRE ORTED TI |

ER COM UTER: |

$0.00 |

TAX ON QUALIFIED PLANS F5329 (PR): |

|

$0.00 |

TAX ON QUALIFIED PLANS F5329 PER COM UTER: |

|

$0.00 |

IRAF TAX PER COMPUTER: |

|

$0.00 |

TP TAX FIGURES (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

IMF TOTAL TAX (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

OTHER TAXES PER COMPUTER: |

|

$0.00 |

UNPAID FICA ON REPORTED TIPS: |

|

$0.00 |

OTHER TAXES: |

|

$0.00 |

RECAPTURE TAX: F8611: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES PER CO PUTER: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY VERIFIED: |

|

$0.00 |

HEALTH COVER GE REC PTURE: F8885: |

|

$0.00 |

RECAPTURE T XES: |

|

$0.00 |

TOTAL SSESSMENT PER COMPUTER: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES PER COMPUTER: |

|

$1,103.00 |

Payments

FEDERAL INCOME TAX WITHHELD: |

$1,000.00 |

|

HEALTH CARE: INDIVIDUAL RESPONSIBILITY: |

$0.00 |

|

HEALTH CARE |

0 |

|

E TIMATED TAX |

PAYMENT : |

$0.00 |

OTHER PAYMENT CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT PER COMPUTER: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT VERIFIED: |

$0.00 |

|

EARNED INCOME CREDIT: |

$0.00 |

|

EARNED INCOME CREDIT PER COMPUTER: |

$0.00 |

|

EARNED INCOME CREDIT NONTAXABLE COMBAT PAY: |

$0.00 |

|

8/9/2018

Page 5 of 6

SCHEDULE 8812 |

NONTAXABLE COMBAT PAY: |

$0.00 |

EXCESS SOCIAL |

SECURITY & RRTA TAX WITHHELD: |

$0.00 |

SCHEDULE 8812 |

TOT SS/MEDICARE WITHHELD: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT PER COMPUTER: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT VERIFIED: |

$0.00 |

AMOUNT PAID WITH FORM 4868: |

$0.00 |

|

FORM 2439 REGULATED INVESTMENT COMPANY CREDIT: |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS: |

$0.00 |

|

SAMPLE |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS PER COMPUTER: |

||

HEALTH COVERAGE TX CR: F8885: |

$0.00 |

|

PREMIUM TAX CREDIT AMOUNT: |

$0.00 |

|

PREMIUM TAX CREDIT VERIFIED AMOUNT: |

$0.00 |

|

PRIMARY NAP FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

|

SECONDARY NAP |

FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

FIRST TIME HOMEBUYER CREDIT REPAYMENT AMOUNT: |

$0.00 |

|

FORM 5405 TOTAL HOMEBUYERS CREDIT REPAYMENT PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER (2): |

$0.00 |

|

FORM 2439 AND |

OTHER CREDITS: |

$0.00 |

TOTAL PAYMENTS: |

$1,000.00 |

|

TOTAL PAYMENTS PER COMPUTER: |

$1,000.00 |

|

Refund or Amount Owed

AMOUNT YOU OWE: |

$103.00 |

APPLIED TO NEXT YEAR'S ESTIMATED TAX: |

$0.00 |

ESTIMATED TAX PENALTY: |

$0.00 |

TAX ON INCOME LESS STATE REFUND PER CO UTER: |

$0.00 |

BAL DUE/OVER PYMT USING TP FIG PER CO PUTER: |

$103.00 |

BAL DUE/OVER PYMT USING CO PUTER FIGURES: |

$103.00 |

FORM 8888 TOTAL REFUND PER CO PUTER: |

$0.00 |

Third Party Designee

THIRD P RTY DESIGNEE ID NU BER: |

|

AUTHORIZ TION INDIC TOR: |

0 |

THIRD RTY DESIGNEE N ME: |

|

Schedule

OCIAL |

ECURITY NUMBER: |

|

EMPLOYER |

ID NUMBER: |

|

BU INE |

NAME: |

|

DE CRIPTION OF BU INE /PROFESSION: |

DRAK |

|

NAICS CODE: |

000000 |

|

ACCT MTHD: |

|

|

FIR T TIME CHEDULE C FILED: |

N |

|

TATUTORY EMPLOYEE IND: |

N |

|

INCOME

GROSS RECEIPTS OR SALES: |

$2,700.00 |

RETURNS AND ALLOWANCES: |

$0.00 |

NET GROSS RECEIPTS: |

$0.00 |

COST OF GOODS SOLD: |

$0.00 |

SCHEDULE C FORM 1099 REQUIRED: |

NONE |

8/9/2018

Page 6 of 6

SCHEDULE C FORM 1099 FILED: |

NONE |

OTHER INCOME: |

$0.00 |

EXPENSES

CAR AND TRUCK EXPENSES: |

$0.00 |

DEPRECIATION: |

$0.00 |

INSURANCE (OTHER THAN HEALTH): |

$0.00 |

MORTGAGE INTEREST: |

$0.00 |

LEGAL AND PROFESSIONAL SERVICES: |

$0.00 |

SAMPLE |

$0.00 |

REPAIRS AND MAINTENANCE: |

|

TRAVEL: |

$0.00 |

MEALS AND ENTERTAINMENT: |

$0.00 |

WAGES: |

$0.00 |

OTHER EXPENSES: |

$0.00 |

TOTAL EXPENSES: |

$200.00 |

EXP FOR BUSINESS USE OF HOME: |

$0.00 |

SCH C NET PROFIT OR LOSS PER COMPUTER: |

$2,500.00 |

AT RISK CD: |

|

OFFICE EXPENSE AMOUNT: |

$0.00 |

UTILITIES EXPENSE AMOUNT: |

$0.00 |

COST OF GOODS SOLD

INVENTORY |

AT |

BEGINNING OF |

YEAR: |

$0.00 |

INVENTORY |

AT |

END OF YEAR: |

|

$0.00 |

Schedule

SSN OF |

|

NET FARM PROFIT/LOSS: SCH F: |

$0.00 |

CONSERVATION RESERVE PROGRAM PAY ENTS: |

$0.00 |

NET NONFARM PROFIT/LOSS: |

$2,500.00 |

TOTAL SE INCOME: |

$2,500.00 |

SE QUARTERS COVERED: |

4 |

TOTAL SE TAX PER COMPUTER: |

$353.12 |

SE INCOME COMPUTER VERIFIED: |

$0.00 |

SE INCOME PER COMPUTER: |

$2,308.00 |

TOTAL NET E RNINGS PER CO PUTER: |

$2,308.00 |

LONG FORM ONLY

TENTATIVE |

CHURCH RNINGS: |

$0.00 |

|

TOTAL SOC |

SEC & RR W GES: |

$0.00 |

|

E |

T X |

COMPUTER: |

$286.19 |

E MEDIC RE INCOME PER COMPUTER: |

$2,308.00 |

||

E MEDICARE TAX PER COMPUTER: |

$66.93 |

||

E FARM OPTION METHOD U ED: |

0 |

||

E OPTIONAL METHOD INCOME: |

$0.00 |

||

Form 8863 - Education Credits (Hope and Lifetime Learning Credits)

PART III - ALLOWABLE EDUCATION CREDITS

GROSS EDUCATION CR PER COMPUTER: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT PER COMPUTER: |

$0.00 |

|

|

|

This Product Contains Sensitive Taxpayer Data |

|

|

|

|

|

|

8/9/2018

File Specs

| Fact Name | Description |

|---|---|

| Document Type | This is a Tax Return Transcript. |

| Sensitivity of Information | Contains Sensitive Taxpayer Data. |

| Request and Response Date | The transcript was requested and responded to on August 9, 2018. |

| Primary Content | Details amounts shown on the original tax return and the adjusted amounts after processing, excluding any subsequent account activity. |

| Governing Law | Federal law, as it pertains to the nationwide process and requirements of filing and interpreting income tax returns. |

Steps to Filling Out Sample Tax Return Transcript

Filling out a Sample Tax Return Transcript form is a step-by-step process that requires attention to detail. Although it might seem daunting at first, breaking the procedure into manageable steps can simplify the task. Whether you're looking at income details, adjustments, or deductions, each section provides crucial information for accurately documenting one's tax history. The ultimate goal is to ensure everything from personal details to financial specifics is correctly entered, mirroring the information on the original return. With the following instructions, you'll be guided through the most important sections to complete the form efficiently.

- Start by reviewing the top section of the form, which contains sensitive taxpayer data. Confirm that the Request Date, Response Date, Tracking Number, Customer File Number, and SSN Provided are all correct.

- Ensure that the Tax Period Ending matches the tax year you are working with, for example, Dec. 31, 2017.

- Verify the taxpayer's Name(s), Address, Filing Status (e.g., Single), and the correct Social Security Number(s).

- Under the Income section, cross-reference and input the Wages, Salaries, Tips, etc., as well as other income types like Business Income or Loss (Schedule C), and any Adjustments to Income, ensuring each matches the figures provided.

- In the Adjustments to Income area, check entries such as the Educator Expenses and Self-Employment Tax Deduction, making sure to input the correct amounts from your documents.

- Move on to the Tax and Credits section, verify data points like the Standard Deduction, Taxable Income, and ensure the Tentative Tax, and other credits are correctly listed as per the tax return information you have.

- Look at the Payments section, confirm the Federal Income Tax Withheld, and any other listed payments or credits, like the Refundable Education Credit, aligning them accurately with the provided information.

- Finally, review the Refund or Amount Owed section carefully, entering the amount you owe or your refund amount and any amounts applied to next year's estimated tax.

- Don't forget to check the Third Party Designee section if applicable, filling out the Designee ID Number, Authorization Indicator, and Designee Name if you want someone else to discuss this return with the IRS on your behalf.

- Lastly, examine the Schedule C--Profit or Loss From Business section if it's relevant to your tax situation, making sure the Social Security Number, Employer ID Number, Business Name, and all other relevant fields accurately reflect your business income and expenses.

Once you've followed these steps, take a moment to review the entire form to ensure accuracy and completeness. Accuracy is crucial in all sections to reflect the financial activities truthfully, avoiding potential issues. Once satisfied, your completed form will be ready for your records or further tax-related processes.

Discover More on Sample Tax Return Transcript

What is a Tax Return Transcript?

A Tax Return Transcript is a document provided by the IRS that includes most of the line items from your original

Common mistakes

When filling out the Sample Tax Return Transcript form, individuals often make mistakes that can lead to inaccuracies in their tax records or processing delays. Here are five common errors:

Incorrect Social Security Numbers (SSNs): Entering an SSN incorrectly for oneself, a spouse, or dependents can result in processing delays or misapplied payments and credits.

Misreporting Income: Failing to accurately report all sources of income, such as wages, business income, or taxable dividends, may lead to audits or penalties.

Overlooking Deductions and Credits: Not claiming eligible deductions and credits, from educator expenses to retirement savings contributions, can result in a higher tax liability.

Incorrect Filing Status: Choosing the wrong filing status affects tax liability, eligibility for certain deductions and credits, and the applicable tax rate.

Math Errors: Simple computation mistakes or incorrectly calculated adjusted gross income, taxable income, and tax credits can result in incorrect tax assessments.

It is crucial to review the information carefully and ensure accuracy in every section of the form to avoid these mistakes. Additionally, consulting a tax professional or using reliable tax preparation software may help prevent these errors.

Documents used along the form

When engaging with the tax system, individuals often encounter the need for various forms and documents beyond just the Sample Tax Return Transcript. This form provides a detailed account of someone's tax filing, including adjusted gross income, tax payments, and potential refunds or amounts owed. However, for a more comprehensive handling of tax-related matters, additional documents are typically required to support or supplement the information found in the tax return transcript.

- Form W-2, Wage and Tax Statement: This crucial document is provided by employers to employees, detailing the amount of wages paid and taxes withheld for the year. It serves as the foundational document for most individual tax returns, supplying essential data for accurately reporting earnings and tax withholdings.

- Form 1099: Various types of Form 1099 exist, each designed to report different kinds of income beyond wages, such as independent contractor income (1099-MISC), interest earnings (1099-INT), and dividends (1099-DIV). These forms help taxpayers report income that may not be subject to regular wage tax withholdings.

- Schedule A (Itemized Deductions): For those who choose to itemize deductions rather than take the standard deduction, Schedule A is used to list allowable deductions, including medical expenses, state and local taxes, mortgage interest, and charitable contributions. Itemizing can provide tax savings for those with significant deductible expenses.

- Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return: This form is utilized when an individual needs more time to prepare their tax return. Filing Form 4868 grants an additional six months to file, although it's important to note that it does not extend the time to pay any tax owed.

Together, these forms create a more complete picture of an individual's fiscal situation for the relevant tax year. Whether it's reporting various kinds of income with the W-2 and 1099 forms, detailing deductions via Schedule A, or requesting more time to file with Form 4868, each document adds a layer of detail and specificity that supports the overall process of tax filing and compliance.

Similar forms

W-2 Form (Wage and Tax Statement): Similar to the Sample Tax Return Transcript, the W-2 form provides detailed information about the income earned by an individual from their employer over the tax year. Both documents outline earnings such as wages, tips, and other compensation, along with federal and state taxes withheld, contributing to the individual's tax obligations and potential refunds.

1099 Forms: These forms are used to report various types of income other than salaries, such as freelance income, interest, dividends, and distributions from a retirement plan. Much like the Tax Return Transcript, they play a critical role in determining the total income reported to the IRS for the tax year, influencing adjustments, taxable income, and credits.

Schedule C (Profit or Loss from Business): This form is used by sole proprietors to report the income or loss from a business. The Tax Return Transcript and Schedule C both summarize business earnings or losses, detailing gross receipts, expenses, and net profit or loss, which affects the taxpayer's adjusted gross income.

Form 1040 (U.S. Individual Income Tax Return): The Form 1040 is the standard federal income tax form many people use to report their income, calculate their tax liability, and claim tax deductions and credits. It is directly reflected in the Tax Return Transcript, which summarizes the information submitted on Form 1040, including the filer's income, adjustments, deductions, taxes owed, and payments made.

Schedule EIC (Earned Income Credit): This schedule supports the calculation and claim of the Earned Income Credit, a refundable tax credit for low- to moderate-income working individuals and families, especially those with children. Similar to parts of the Tax Return Transcript, it details income and adjusts it for specific credits, helping to reduce the amount of tax owed and potentially leading to a refund.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, there are important steps you should take to ensure the accuracy and completeness of your submission. Below are the things you should and shouldn't do:

Things You Should Do:

- Double-check all the numbers you enter against your tax return documents to ensure accuracy.

- Make sure you fill in every required field with the correct information to avoid processing delays.

- Include the tracking number given to you, as it helps in tracking the status of your transcript request efficiently.

- Verify the social security numbers (SSN) listed, including the SSN for the spouse if applicable, to ensure they match the numbers on your social security card.

Things You Shouldn't Do:

- Do not leave any sections that apply to you blank. Incomplete information can lead to processing errors.

- Avoid guessing amounts or information. If you're unsure, refer to your tax records or seek professional advice.

- Don't ignore the differences in amounts shown on the return (PR) and the amounts as adjusted (PC), if applicable. Understanding these differences can be important for your records.

- Resist the temptation to make corrections directly on the transcript form. Instead, note any discrepancies and consult with a tax professional on how to proceed.

Misconceptions

There are several misconceptions about the Sample Tax Return Transcript form that can lead to confusion. Understanding these misconceptions is important to ensure accuracy and compliance when dealing with tax information. Below are four common misconceptions explained:

- It shows the most up-to-date information: Many believe that the tax return transcript reflects real-time account activities and updates. However, it only shows the information as adjusted, if applicable, at the time of the original filing. It does not include any changes or transactions made on the account after the response date.

- It's equivalent to a copy of the tax return: Another common misconception is that the tax return transcript is a straight copy of the filed tax return. While it contains most of the line items from the original return, including adjusted income, it does not display the actual tax form as submitted. Instead, it provides a summary of the return data.

- It includes detailed information on all schedules and forms: The transcript provides a high-level summary of the schedules and forms submitted with the tax return, rather than a detailed line-by-line account. For instance, it will summarize the totals from schedules like Schedule C but does not delve into minute details such as expenses listed individually.

- All sections are relevant for every taxpayer: The transcript includes various sections that may not apply to every taxpayer, such as "SE TAX," "SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS," or specifics about credits and deductions that were not claimed by the taxpayer. This broad scope often leads to the incorrect assumption that all sections must be filled or are relevant to their tax situation.

Understanding the structure and limitations of the Sample Tax Return Transcript form can significantly aid taxpayers in accurately interpreting their tax information without misconceptions. This clarity is crucial for making informed decisions and ensuring compliance with tax regulations.

Key takeaways

Filling out a Sample Tax Return Transcript form accurately is crucial for understanding your tax situation. Here are key takeaways to help you navigate the essentials of this document:

- The Tax Return Transcript shows a taxpayer's filing information, such as income and deductions as reported to the IRS.

- It details not only the original figures submitted but also any adjustments made by the computer (PC) if applicable.

- Understanding the "adjustments to income" section can provide insights into certain deductions you may qualify for in reducing your taxable income.

- The section on Tax and Credits gives a snapshot of the standard deductions, exemptions, and credits applied to reduce the overall tax liability.

- It's important to note that the transcript will indicate your filing status and any dependent information claimed on your return. This can affect your eligibility for certain tax benefits.

- The transcript details various types of income, such as wages, business income (Schedule C), and dividends, helping you understand how each contributes to your total income figure.

- Any taxes owed or refund amounts are summarized under the Refund or Amount Owed section, providing a clear picture of your final tax position for the year.

- The document also includes information about any third-party designee authorized to discuss the return with the IRS, ensuring privacy and security of taxpayer information.

Having a comprehensive understanding of each section of the Tax Return Transcript can aid in tax planning and ensuring compliance with IRS requirements.

Common PDF Forms

Cg2010 Form - Inclusion of additional insureds under this endorsement is specifically tailored to cover liabilities arising from the named policyholder’s operations conducted for the benefit of those added entities.

Trader Joes - Our form includes sections for personal information, educational background, and references to get to know you better.