Free Stock Transfer Ledger PDF Form

At the heart of tracking and managing the equity of a corporation lies the Stock Transfer Ledger, a crucial document that provides a comprehensive record of stock issuance and transfers. This ledger is not only a historical document but also a current snapshot of the company's ownership structure. By meticulously recording details such as the stockholder's name, residence, certificate numbers, and shares, the ledger offers transparency and regulatory compliance. It documents every significant step in the lifecycle of a share, from issuance, noting the original owner or if the shares were transferred, to recording the payment made for those shares. Furthermore, it tracks the movement of shares from one owner to another, including the surrender of certificates and the balance of shares held after any transaction. This form serves as an essential tool for internal governance and external reporting, giving insight into the company's capital structure and the distribution of its ownership.

Sample - Stock Transfer Ledger Form

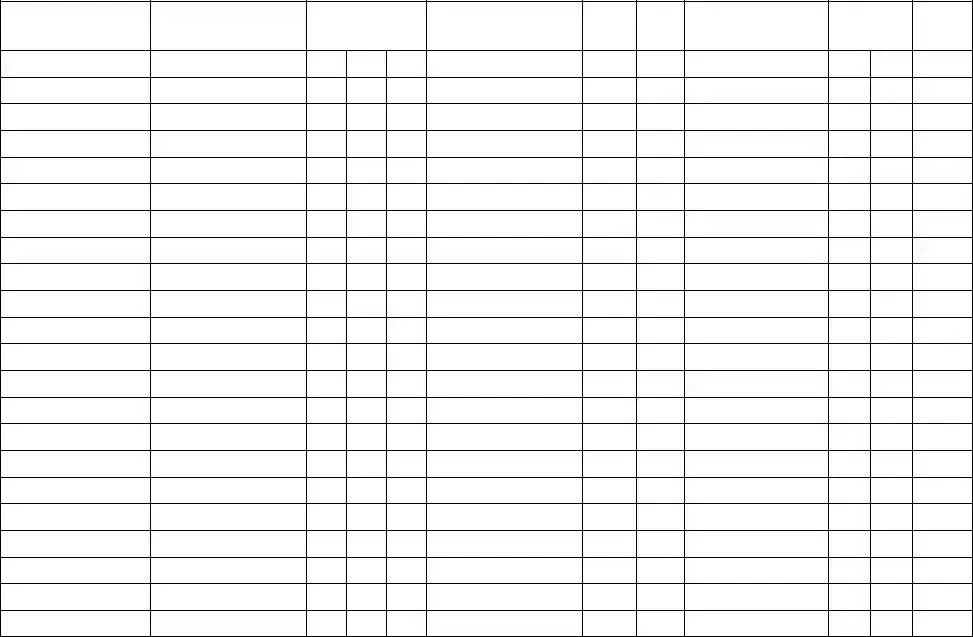

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

File Specs

| Fact Number | Detail |

|---|---|

| 1 | The Stock Transfer Ledger form is used for tracking the issuance and transfer of a corporation's stock. |

| 2 | It requires the corporation's name to be entered, ensuring the record is specific to the entity. |

| 3 | Information recorded includes the stockholder's name, residence, and certificate numbers related to the stocks issued or transferred. |

| 4 | Details of stock transactions, including date of issuance or transfer, number of shares, and payment amount are documented. |

| 5 | For stock transfers, it captures the origin and destination of shares, including from whom and to whom shares were transferred. |

| 6 | The form provides a systematic way to keep a balance on the number of shares held after each transaction. |

| 7 | Governing laws vary by state, but this document generally supports transparency and accuracy in financial and corporate governance reporting requirements. |

Steps to Filling Out Stock Transfer Ledger

When managing a corporation's shares, precision is key. The Stock Transfer Ledger form serves as a critical tool for tracking the issuance and transfer of stock within a corporation. Filling out this form accurately ensures that the company maintains a clear record of share ownership—vital for legal compliance, shareholder communication, and overall corporate governance. By following the steps outlined below, one can complete the Stock Transfer Ledger form with confidence, contributing to the company's orderly record-keeping and administrative efficiency.

- Enter the Corporation’s Name at the top of the form where indicated. Ensure the name matches the official corporation name registered.

- Fill in the Name of the Stockholder who currently owns the shares. Include any middle initials or suffixes to avoid confusion with similar names.

- Record the Place of Residence of the stockholder. Provide a complete address, including the city, state, and zip code, to ensure accurate records for correspondence.

- Detail the Certificates Issued, including:

- Cert. No. (Certificate Number)

- Date of Issuance

- No. of Shares (Number of Shares Issued)

- State the Amount Paid on the shares. This could reflect the par value of the shares or the amount above par value (premium) that the shareholder paid.

- Document the Transfer of Shares, including:

- Date of Transfer

- To Whom Shares Were Transferred

- Input the Certificates Surrendered information if applicable, including:

- Cert. No. (Certificate Number)

- No. Shares (Number of Shares)

- Update the Number of Shares Held (Balance). After the transaction, record the new total number of shares that the stockholder now possesses. This helps in keeping an accurate count of shares for each stockholder.

Completing the Stock Transfer Ledger form is a straightforward process that plays a crucial role in the administration of a corporation's equity. It ensures a transparent and lawful record of share transactions, aiding in the effective governance and operational integrity of the corporation. Taking the time to accurately fill out this form contributes significantly to the company’s due diligence and legal compliance, fostering trust and confidence among shareholders and regulatory bodies alike.

Discover More on Stock Transfer Ledger

What is a Stock Transfer Ledger and why is it necessary?

A Stock Transfer Ledger is a record-keeping document used by corporations to track the issuance and transfer of stock shares. It details the transactions involving the company's stock, noting the name of the stockholder, their place of residence, number of shares issued, certificate numbers, and pertinent dates related to the issuance and transfer of shares. This ledger is essential for maintaining an accurate and up-to-date record of stock ownership, which is necessary not only for corporate governance but also for legal compliance and financial reporting. It ensures that the corporation can accurately identify its shareholders at any given time, which is crucial during corporate voting, dividend distributions, and other stock-related activities.

How do you fill out the Stock Transfer Ledger form?

To fill out the Stock Transfer Ledger form, you begin by entering the corporation’s name at the top. Then, input detailed information about each stock transaction, including the stockholder’s name, their residence, and the specifics of the stock certificates issued, such as the certificate numbers, the number of shares issued, and the price paid for these shares. For each transaction, note whether it involves the issuance of new shares or the transfer of existing ones, including details about the transfer source and the recipient, as well as any surrendered certificates. It's crucial to record every transaction accurately to maintain a clear history of share ownership and transactions within the corporation.

Who should maintain the Stock Transfer Ledger?

It is typically the responsibility of the corporate secretary or another designated officer within the corporation to maintain the Stock Transfer Ledger. This role involves ensuring that the ledger is up-to-date and accurately reflects all stock issuances and transfers. Because the ledger serves as the official record of share ownership, the individual maintaining it must have a thorough understanding of corporate record-keeping practices and ensure adherence to state laws and regulations governing stock transactions and corporate records. Regular audits of the ledger might also be conducted to ensure its accuracy and compliance.

What happens if there are errors in the Stock Transfer Ledger?

If errors are discovered in the Stock Transfer Ledger, they must be corrected promptly to ensure the document accurately reflects the actual share ownership and transactions. The process for correcting errors may vary depending on the nature of the mistake but typically involves making the necessary adjustments and noting the correction's date and reason. It’s crucial to maintain transparency in the correction process to uphold the ledger's integrity and ensure trust amongst shareholders and regulatory bodies. In some cases, notifying affected parties about the correction may be necessary or advisable.

Is access to the Stock Transfer Ledger restricted, and if so, to whom?

Yes, access to the Stock Transfer Ledger is typically restricted due to the sensitive nature of the information it contains. Access is generally limited to individuals within the corporation who have a legitimate need to know the information, such as corporate officers responsible for record-keeping, legal compliance, and financial management. In some cases, external entities like auditors or regulatory bodies may also be granted access for purposes of verification or investigation. However, strict controls and confidentiality agreements are often in place to protect shareholder privacy and prevent misuse of the information contained in the ledger.

Common mistakes

When filling out the Stock Transfer Ledger form, many people tend to overlook or incorrectly manage several details that are crucial for accurate and legal record-keeping. Below are nine common mistakes to be aware of:

- Not entering the corporation's name accurately: The form begins with a space to enter the corporation's name. This is often filled in hastily or with abbreviations, which can lead to confusion or legal discrepancies.

- Omitting the full name of the stockholder: It's important to use the full legal name of the stockholder to avoid any ambiguity or issues with identifying the correct individual.

- Incorrect place of residence: Failing to provide the complete and accurate place of residence for the stockholder can lead to issues in official communications or legal notices.

- Misunderstanding Certificate Issuance fields: Many people get confused about what to enter under "Certificates Issued," specifically Cert. No., Date, No. of Shares Issued. These details must accurately reflect the official stock certificates.

- Leaving payment details incomplete: The "Amount Paid Thereon" field is crucial for financial records, yet it's often left blank or inaccurately filled out.

- Forgetting the original source in transfers: The section "From Whom Shares Were Transferred" is sometimes left blank or incorrectly filled. Even if it's an original issue, stating it as such clarifies the stock's origin.

- Errors in the Date of Transfer: This date must be accurate to ensure legal compliance and proper record-keeping. It is frequently entered incorrectly.

- Inaccurately naming the new owner: The field "To Whom Shares Were Transferred" must be filled accurately. Mistakes here can lead to significant confusion about ownership.

- Confusion over certificates surrendered: Individuals often misunderstand the "Certificates Surrendered" section, leading to inaccuracies in how many shares were surrendered and their specific certificate numbers.

To avoid these mistakes, individuals should double-check all entries for accuracy, consult with a professional if necessary, and ensure that all information is complete and correct. Precise record-keeping is essential for legal and financial reasons, making it crucial to approach this task with the seriousness and attention to detail it warrants.

Documents used along the form

Managing the transfer and issuance of stock in a corporation involves meticulous record-keeping and the use of various forms and documents beyond just the Stock Transfer Ledger. This ledger is crucial for maintaining an accurate record of stock transactions, tracking the shares each stockholder owns, and providing a history of how those shares have been bought, sold, or otherwise transferred. However, to ensure compliance and facilitate these transactions, several other documents are commonly used in conjunction with the Stock Transfer Ledger.

- Corporate Bylaws: These are the rules that govern the operation of the corporation. They include details on how stock transfers are to be handled, making them an essential reference for maintaining the Stock Transfer Ledger.

- Stock Certificates: These certificates serve as physical proof of stock ownership. Information from issued or transferred stock certificates is recorded in the Stock Transfer Ledger.

- Stock Power Form: This is a legal document that shareholders use to endorse the transfer of their stock to another party. It typically accompanies the stock certificate when a transfer is made.

- Minutes of Board Meetings: These minutes often contain approvals for stock issuances and transfers. They provide a formal record that such actions were authorized by the corporation's board of directors.

- Shareholder Agreements: These agreements might include clauses that affect the transfer of stock, such as pre-emptive rights or buy-sell agreements, and therefore, impact entries in the Stock Transfer Ledger.

- Articles of Incorporation: This document establishes the corporation and includes information that can affect stock, such as the authorized share capital. It provides a backdrop for the Stock Transfer Ledger's context.

- Securities Transfer Form: This form is used for the transfer of listed securities. In some cases, if the corporation's stock is publicly traded, this form might be necessary for recording transfers in the ledger.

The usage of these documents, in combination with the Stock Transfer Ledger, creates a comprehensive system for tracking and validating stock ownership and transfers within a corporation. Each document plays a specific role in the lifecycle of a stock transaction, supporting legal and financial accountability. For anyone managing corporate records or dealing with corporate stock, understanding how these documents interact with the Stock Transfer Ledger is key to ensuring that stock transactions are conducted smoothly and in compliance with the governing corporate and securities laws.

Similar forms

The Stock Transfer Ledger form is a crucial document for corporations, meticulously recording the issuance and transfer of stock shares. Its purpose is closely related to several other legal documents that are essential for the management and operation of businesses. The documents similar to a Stock Transfer Ledger share the common goal of tracking financial or ownership stakes within a legal entity or financial instrument. Here are five documents that bear similarities to the Stock Transfer Ledger form:

- Shareholder Agreement: This document outlines the rights and obligations of shareholders within a corporation. Similar to the Stock Transfer Ledger, a Shareholder Agreement details the ownership structure of the company but goes further by dictating the terms under which shares can be bought, sold, or transferred, and how disputes among shareholders will be resolved.

- Membership Interest Ledger: For limited liability companies (LLCs), the Membership Interest Ledger serves a purpose akin to that of the Stock Transfer Ledger in corporations. It tracks the ownership percentages (or units) and the transfer of these interests among members. Both ledgers are foundational for ensuring accurate records of ownership and for the processing of buy-sell transactions among owners.

- Corporate Bylaws: Although broader in scope, Corporate Bylaws intersect with the function of a Stock Transfer Ledger by defining the procedures for issuing, transferring, and recording stock shares. Bylaws establish the framework within which the Stock Transfer Ledger operates, particularly by setting forth the governance structure of the corporation and the rights and responsibilities of its shareholders.

- Securities Registration: This document is filed with regulatory authorities and contains details about the company’s securities that will be offered to the public or private investors. Similar to a Stock Transfer Ledger, it provides transparency about the company’s financial instruments, including stocks, but from a regulatory compliance perspective, ensuring that all offerings are made lawfully and with full disclosure.

- Cap Table (Capitalization Table): A cap table is a spreadsheet or table that displays the total ownership stakes, including equity shares, preferred shares, options, and warrants of a company. Like the Stock Transfer Ledger, a cap table is vital for managing and tracking the equity structure and ownership changes within a company. While the Stock Transfer Ledger focuses on the transactional details of stock transfers, the cap table provides a snapshot of who owns what at any given point in time.

Each of these documents, while serving distinct purposes, complements the Stock Transfer Ledger in ensuring the accurate record-keeping and management of a company’s ownership and financial dealings. Understanding their similarities helps in comprehensively managing a corporation's legal and financial health.

Dos and Don'ts

When it comes to filling out the Stock Transfer Ledger form, accuracy and detail are key. Here are some important do's and don'ts to remember:

Do:- Double-check the corporation's name before entering it. Ensure it's spelled correctly and matches the official records.

- Provide complete information for each section. This includes the stockholder's full name, correct place of residence, and details of the stock certificates issued or transferred.

- Be precise with numbers. Double-check the certificate numbers, the number of shares issued, transferred, and the balance held after the transaction. Any inaccuracies can lead to confusion or disputes later on.

- Update the ledger promptly after any transaction. This ensures that the records accurately reflect the current stock ownership and transfers.

- Avoid guessing or leaving fields blank. If you're unsure about the information, confirm it before entry. Incomplete records can lead to legal complications.

- Overwrite or use correction fluid on errors. If a mistake is made, draw a single line through the incorrect entry and write the correct information neatly above or beside it. Initial any changes you make.

- Forget to verify the stockholder’s identity and details. This helps prevent fraudulent transfers and ensures that records are accurate and secure.

- Delay the update of other related documents. The information in the stock transfer ledger should match all other corporate records, including the list of stockholders and their share certificates.

Following these guidelines helps maintain a clear, legal record of stock ownership and transfers within a corporation, which is essential for both the company's management and its shareholders.

Misconceptions

Understanding the Stock Transfer Ledger form is crucial for maintaining accurate records of a corporation's shares and their movements. However, there are several misconceptions that people often have about this essential document. Let's clear up five of these common misunderstandings.

- Misconception 1: It's only for large corporations. Many believe that the Stock Transfer Ledger form is relevant only for large corporations with hundreds of shareholders. This isn't true. Even small corporations, including those with a single shareholder, should maintain this ledger to ensure a clear record of share issuance and transfers. It's fundamental for managing ownership accurately, regardless of company size.

- Misconception 2: It's too complicated to maintain. While the form involves detailed information, its maintenance is straightforward once you understand what each section represents. With consistent record-keeping habits, it becomes a manageable and routine part of corporate administration.

- Misconception 3: Digital records have made it obsolete. The rise of digital record-keeping has made maintaining records more convenient, but it hasn't eliminated the need for a Stock Transfer Ledger. This ledger provides a clear, historical account of share movements that can be essential during audits, legal scrutiny, or sales discussions. Digital systems complement the ledger by simplifying its maintenance, not by replacing it.

- Misconception 4: It's only about the stock transfers. While stock transfers between parties are a significant focus, the ledger also details issuances, including the initial ones, and the surrendering of shares. It records the entire lifecycle of a share, from issuance to transfer or surrender, making it a comprehensive document for understanding a corporation’s share history.

- Misconception 5: Only accountants or financial professionals can update it. While it's beneficial for someone with financial knowledge to manage the ledger, it's not exclusive to them. With basic training, any designated individual within the corporation can update the ledger accurately. Ensuring that the information is current and correct is more about diligence than about having specific professional qualifications.

Understanding these misconceptions helps clarify the Stock Transfer Ledger's role in corporate governance. Maintaining this ledger accurately is not just a legal requirement but a best practice that supports clear and transparent share management and ownership structure.

Key takeaways

When handling a Stock Transfer Ledger form, several key points ensure accuracy and completeness in recording the transfer and issuance of stock. This ledger serves as a formal record, keeping track of the ownership changes in a corporation. Understanding how to fill out and use this form correctly can help maintain orderly records and support legal and financial processes.

- Details of the Corporation: The first step involves listing the corporation's name for which the stock transfer or issuance ledger is being maintained. This ensures that all entries and records are correctly attributed to the specific corporate entity.

- Stockholder Information: Each entry must include comprehensive details about the stockholder, such as their full name and place of residence. This information is crucial for identifying the stockholder and for any future communications or legal necessities.

- Certificate and Share Details: The ledger should clearly record each stock certificate’s issuance and transfer. This includes the certificate number, the date of issuance or transfer, the number of shares issued, and the amount paid for those shares. Precise record-keeping is essential for tracking ownership and ensuring the corporation’s share structure is accurately reflected.

- Transfer Specifics: For each stock transfer, the form should detail from whom the shares were transferred (or note if it's an original issue) and to whom they are transferred. In addition, it must include any certificates surrendered during the transfer process, with certificate numbers and the number of shares surrendered listed.

- Ownership Balance: After each transaction, the ledger must update the balance of shares held by the stockholder. This column reflects the current number of shares the stockholder owns after each issuance or transfer, providing a clear snapshot of shareholder equity at any given time.

Proper maintenance of the Stock Transfer Ledger is a fundamental aspect of corporate record-keeping. It not only facilitates efficient share tracking and transfers but also supports regulatory compliance and financial management. Ensuring that each entry is accurate and complete bolsters the integrity of the corporation’s financial and legal standing.

Common PDF Forms

Pre Trip Inspection Class a Pdf With Pictures - Filling out the checklist before each trip is a best practice in the transportation industry.

California Disability Benefits - This form is part of an essential safety net for workers in California, allowing them to heal without the added burden of financial strain.

Prescription Slip - Assists healthcare providers in managing patient care through accurately prescribed medicines and treatment courses.