Free Texas Odometer Statement PDF Form

When buying or selling a vehicle in Texas, an important legal document comes into play: the Texas Odometer Statement form, officially known as VTR-40 (Rev. 11/09). This form acts as a declaration from the seller or agent regarding the vehicle's actual mileage, a critical piece of information in the transaction. Federal and Texas state laws mandate the disclosure of accurate mileage during the ownership transfer to ensure transparency and protect buyer rights. Failure to accurately complete the form or intentionally providing false information can lead to serious consequences, including fines and imprisonment. The form requires detailed vehicle description including year, make, model, and vehicle identification number. It becomes a vital document particularly for vehicles with titles issued after April 29, 1990, which adhere to strict federal and state odometer disclosure standards. The form features a section for the seller or agent to certify the accuracy of the odometer reading, with options to indicate if the mileage exceeds the mechanical limits of the vehicle or if the odometer reading is not reflective of the actual mileage, signaling a discrepancy. In acknowledging the odometer disclosure, the buyer or their agent also provides confirmation of understanding the seller’s certification. This careful process, underscored by legal stipulations, emphasizes the importance of truthful mileage disclosure in upholding the integrity and fairness of vehicle transactions in Texas.

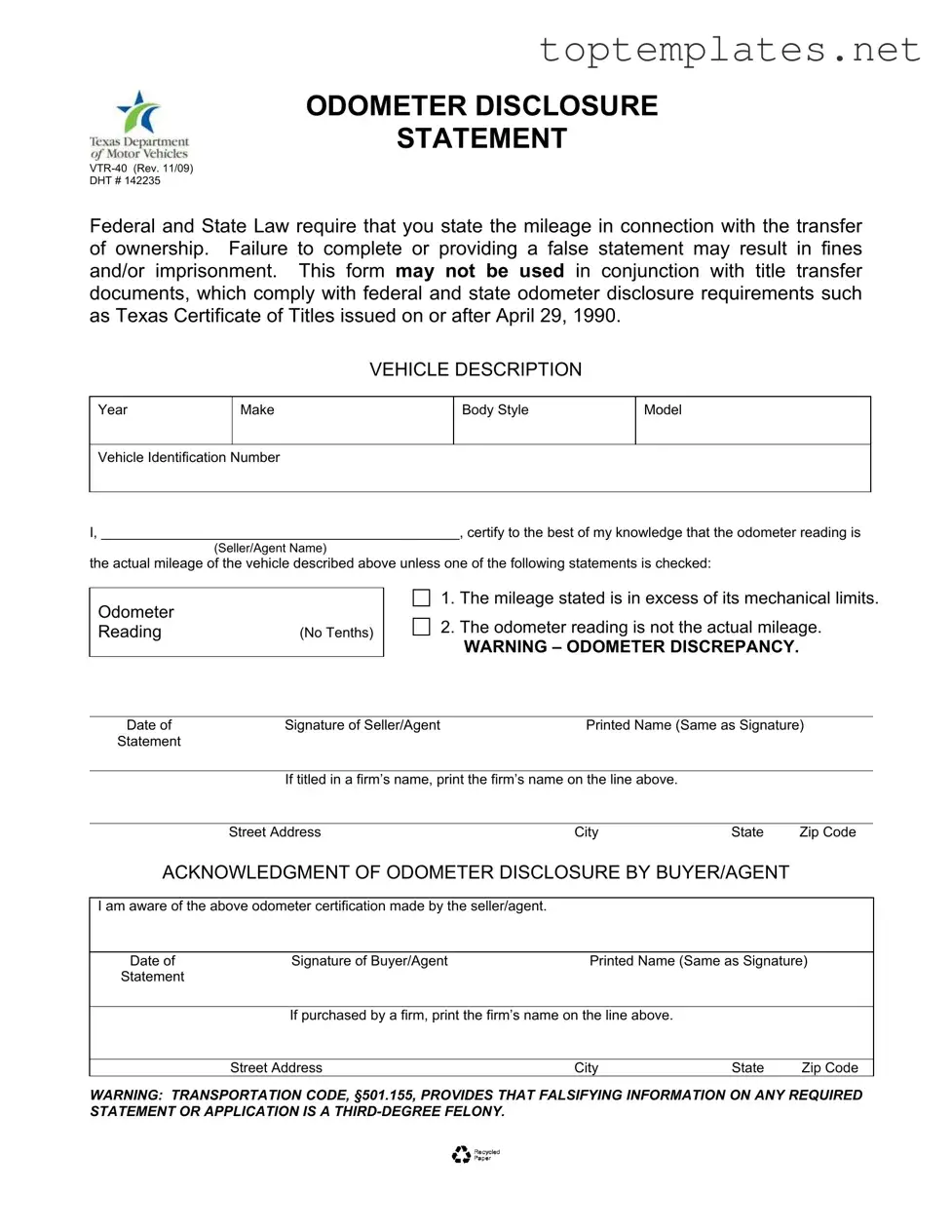

Sample - Texas Odometer Statement Form

ODOMETER DISCLOSURE

STATEMENT

DHT # 142235

Federal and State Law require that you state the mileage in connection with the transfer of ownership. Failure to complete or providing a false statement may result in fines and/or imprisonment. This form may not be used in conjunction with title transfer documents, which comply with federal and state odometer disclosure requirements such as Texas Certificate of Titles issued on or after April 29, 1990.

VEHICLE DESCRIPTION

Year

Make

Body Style

Model

Vehicle Identification Number

I, ______________________________________________, certify to the best of my knowledge that the odometer reading is

the actual mileage of the vehicle described above unless one of the following statements is checked:

Odometer

Reading |

(No Tenths) |

1.The mileage stated is in excess of its mechanical limits.

2.The odometer reading is not the actual mileage.

WARNING – ODOMETER DISCREPANCY.

Date ofSignature of Seller/AgentPrinted Name (Same as Signature) Statement

If titled in a firm’s name, print the firm’s name on the line above.

Street Address |

City |

State |

Zip Code |

ACKNOWLEDGMENT OF ODOMETER DISCLOSURE BY BUYER/AGENT

I am aware of the above odometer certification made by the seller/agent.

Date of |

Signature of Buyer/Agent |

Printed Name (Same as Signature) |

Statement |

|

|

If purchased by a firm, print the firm’s name on the line above.

Street Address |

City |

State |

Zip Code |

WARNING: TRANSPORTATION CODE, §501.155, PROVIDES THAT FALSIFYING INFORMATION ON ANY REQUIRED STATEMENT OR APPLICATION IS A

File Specs

| Fact | Description |

|---|---|

| Form Title | ODOMETER DISCLOSURE STATEMENT VTR-40 (Rev. 11/09) |

| Laws Governing the Form | Federal and State Law require stating the mileage during ownership transfer. Specifically, the form mentions TRANSPORTATION CODE, §501.155 regarding falsification being a third-degree felony. |

| Application Restrictions | This form cannot be used with title transfer documents that comply with federal and state odometer disclosure requirements for Texas Certificate of Titles issued after April 29, 1990. |

| Odometer Disclosure Statements | Sellers must certify the accurate odometer reading unless it's beyond its mechanical limits or not the actual mileage, indicating a potential odometer discrepancy. |

| Seller and Buyer Acknowledgment | Both the seller/agent and buyer/agent must sign and print their names, acknowledging the odometer certification and their awareness of it. |

| Penalties for Falsification | Providing false information on the Texas Odometer Statement form may lead to fines and/or imprisonment, specifically under the TRANSPORTATION CODE, §501.155 as a third-degree felony. |

Steps to Filling Out Texas Odometer Statement

Filling out the Texas Odometer Statement form is a critical step in the process of transferring vehicle ownership. This document ensures that the buyer is fully aware of the mileage on the vehicle they are purchasing, as required by federal and state law. Incorrect completion or intentional misinformation can lead to serious penalties, including fines and imprisonment. Follow these steps carefully to complete the form accurately.

- At the top of the form, where it says "Seller/Agent Name," write the name of the individual or entity selling the vehicle.

- Under "VEHICLE DESCRIPTION," fill in the year, make, body style, model, and vehicle identification number (VIN) of the vehicle being sold.

- In the blank space provided before the certification statement, enter the seller's or agent's full name.

- Directly below, fill in the "Odometer Reading (No Tenths)" with the current mileage of the vehicle as shown on the odometer. Do not include tenths of miles.

- If applicable, check one of the boxes to indicate if the mileage stated is in excess of its mechanical limits or if the odometer reading is not the actual mileage. If neither of these statements is true, leave both boxes unchecked.

- Enter the date of the odometer disclosure next to "Date of Statement."

- Sign the form where it says "Signature of Seller/Agent" and then print the same name directly below where it indicates "Printed Name (Same as Signature)."

- If the vehicle is titled in a firm’s name, enter the firm's name where indicated.

- Fill in the street address, city, state, and zip code of the seller or agent.

- In the "ACKNOWLEDGMENT OF ODOMETER DISCLOSURE BY BUYER/AGENT" section, the buyer or the buyer’s agent acknowledges the odometer disclosure. Enter the date and have the buyer or agent sign and print their name in the spaces provided. If the buyer is a firm, include the firm's name as well.

- Complete the buyer/agent section with the street address, city, state, and zip code, similar to the seller/agent section.

Once both parties have completed their respective sections of the form, it's crucial to review all entries for accuracy. Remember, this form is an important legal document, serving as a record of the odometer reading at the time of the vehicle's sale. Proper completion helps protect both the seller and the buyer and ensures compliance with the law.

Discover More on Texas Odometer Statement

What is the purpose of the Texas Odometer Statement form (VTR-40)?

The Texas Odometer Statement form, designated as VTR-40, is intended to record the accurate mileage of a vehicle at the time of its sale or transfer of ownership. Federal and state laws mandate the disclosure of a vehicle's mileage to ensure transparency and prevent fraud during transactions. This form helps in providing a clear record that aids in preserving the integrity of the buying and selling process.

Who needs to complete the Texas Odometer Statement form?

Both the seller or the agent representing the vehicle and the buyer or the buyer's agent are required to complete the Texas Odometer Statement form during the transfer of ownership. It is essential for ensuring that both parties acknowledge the reported odometer reading at the time of sale.

Are there any penalties for not completing the form or providing false information?

Yes, failure to complete the form or providing false information can lead to significant consequences, including fines and/or imprisonment. According to the transportation code, falsifying information on this required statement or application is considered a third-degree felony.

Can this form be used for all vehicle transactions?

No, the form cannot be used in conjunction with title transfer documents that comply with federal and state odometer disclosure requirements for vehicles titled on or after April 29, 1990. It is specifically designed for certain transactions that require a separate odometer disclosure statement.

What should I do if the mileage exceeds the mechanical limits of the odometer?

If the vehicle's mileage exceeds its mechanical limits, there is a specific option on the form that you should check to indicate this situation. This declaration helps in accurately recording the status of the vehicle's mileage for the buyer and any future transactions.

What if the odometer reading is not the actual mileage?

If the odometer reading does not reflect the actual mileage of the vehicle, for reasons such as odometer tampering or malfunction, there is an option on the form to indicate that the odometer discrepancy exists. Choosing this option alerts the buyer to a potential discrepancy in the vehicle's mileage.

Is acknowledgment by the buyer/agent required?

Yes, acknowledgment by the buyer or the buyer's agent is a mandatory part of the Texas Odometer Disclosure statement process. The buyer or agent must be made aware of the odometer certification provided by the seller and indicate their acknowledgment by signing the form. This ensures that the buyer is fully informed about the vehicle's mileage as claimed by the seller.

What information is needed to complete the form?

To complete the form, information required includes the vehicle's year, make, body style, model, and vehicle identification number (VIN). Additionally, the form requires the odometer reading (without tenths), the seller’s and buyer’s printed names and signatures, their respective street addresses, and the dates of the signatures. This comprehensive information ensures clear identification of the vehicle and parties involved in the transaction.

Common mistakes

Filling out official documents correctly is crucial to ensure the smooth transfer of a vehicle’s ownership. The Texas Odometer Statement form VTR-40 is a vital piece of documentation that must be completed with a great deal of care. Unfortunately, several common mistakes are made during this process. Recognizing and avoiding these mistakes will not only keep you in compliance with both federal and state laws but also protect you from potential fines or imprisonment.

Not stating the mileage accurately or attempting to falsify the odometer reading. Federal and state laws mandate the disclosure of a vehicle's accurate mileage during ownership transfer. Misrepresenting this information is a serious offense.

Overlooking the checkboxes that indicate if the mileage exceeds the mechanical limits of the odometer or if the odometer reading is not the actual mileage. These are critical distinctions that must be made clear on the form.

Completing the form without ensuring that the vehicle information (year, make, body style, model, vehicle identification number) precisely matches the vehicle being sold. Inaccuracies here could invalidate the document.

Forgetting to print the name exactly as it appears in the signature line. This consistency is necessary for the form to be legally binding and recognized.

Omitting the date of signature for both the seller/agent and the buyer/agent. These dates are important to establish the timeline of the ownership transfer.

Leaving the address fields incomplete. Both the seller's and buyer's addresses are required for a complete and valid odometer disclosure statement.

In summary, when completing the Texas Odometer Statement, thoroughness and attention to detail are paramount. Ensuring accuracy not only in the mileage disclosed but also in the completeness of every section of the form, can prevent legal complications and confirm the credibility of the transaction. Errors or omissions, seemingly minor at the moment, can have significant consequences and disrupt what should be a straightforward process of vehicle transfer.

Documents used along the form

When handling vehicle transactions in Texas, particularly regarding the sale or transfer of ownership, the Texas Odometer Statement form is just one of several documents that parties may need to gather and complete. This form serves as a crucial piece of record keeping, ensuring transparency and honesty about a vehicle's mileage. However, to fully comply with Texas laws and regulations and to ensure a smooth transfer process, several other forms and documents are often required in addition to the Texas Odometer Statement form.

- Application for Texas Title and/or Registration (Form 130-U): This form is essential for the official transfer of the title and registration of the vehicle into the buyer's name. It collects detailed information about the vehicle, seller, and buyer.

- Bill of Sale: A bill of sale provides proof of the transaction between the seller and the buyer, detailing the sale price, vehicle description, and the date of sale. It serves as a receipt for the purchase.

- Vehicle Inspection Report (VIR): Texas requires a passing vehicle inspection report for the registration of vehicles. This document verifies that the vehicle meets safety and emissions standards.

- Proof of Insurance: Texas law mandates that a vehicle must be insured to be registered; thus, new owners must provide proof of insurance that meets the state's minimum coverage requirements.

- Release of Lien (if applicable): If the vehicle was previously financed and the lienholder has released their interest in the vehicle, this document is necessary to remove the lien from the title during transfer.

- Power of Attorney (if applicable): In cases where either the seller or the buyer cannot be present to sign the required documents, a power of attorney may be used to grant authority to another individual to act on their behalf.

- Limited Power of Attorney for Eligible Motor Vehicle Transactions (VTR-271): This specific form of power of attorney allows an individual to make decisions concerning the titling and registration of a vehicle on behalf of the owner or lienholder.

- Gift Affidavit (if applicable): If the vehicle is being transferred as a gift, this document clarifies the relationship between the donor and the recipient and affirms that the vehicle is indeed a gift.

Together, these forms and documents ensure that the vehicle transaction complies with Texas law, providing a complete and official record of the transfer. It's important for individuals involved in such transactions to understand the purpose of each document and to ensure all paperwork is properly completed and submitted to avoid any legal or administrative issues.

Similar forms

Bill of Sale: Similar to the Texas Odometer Statement form, a Bill of Sale is a document that provides proof of a transaction between a seller and a buyer. It typically includes detailed information about the item being sold, the sale price, and the date of sale. Both documents are essential in the transfer of ownership and offer legal protection by documenting the terms of the sale agreement.

Vehicle Title Transfer: This document, like the Odometer Disclosure Statement form, is used in the process of transferring ownership of a vehicle. The vehicle title transfer specifically changes the legal ownership of the vehicle and usually requires an odometer statement to comply with federal and state regulations, highlighting the vehicle's condition and mileage.

Warranty Deed: A Warranty Deed transfers property ownership with a guarantee that the seller holds clear title to the property. Similar to the odometer statement, it ensures the recipient is fully aware of what they are receiving, albeit real estate instead of a vehicle, by providing crucial information and guarantees about the property’s status.

Power of Attorney for Motor Vehicle: This document authorizes an individual to act on behalf of another in terms of vehicle transactions, including title transfers and odometer disclosure statements. It is similar because it often necessitates accurate and truthful information about the vehicle's mileage for legal and record-keeping purposes.

Lease Agreement: A Lease Agreement, while primarily used for property rentals, shares a common feature with the Odometer Statement in its requirement for clear, accurate information critical to the agreement. The Odometer Statement ensures buyers are aware of the vehicle's mileage, whereas lease agreements detail the terms, conditions, and duration of a rental period.

Loan Agreement: Similar to an Odometer Disclosure Statement, a loan agreement must contain clear, accurate details about the loan terms. Where the Odometer Statement verifies mileage to protect buyer and seller interests, a loan agreement details the amount borrowed, interest rates, repayment schedule, and security information to protect the interests of the lender and borrower.

Vehicle Registration Form: This form is required for the legal operation of a vehicle on public roads and, like the Odometer Statement, contains vital information about the vehicle, including make, model, year, and VIN. Accurate odometer readings can also be required for registration purposes in certain jurisdictions to assess the vehicle's value and condition.

Conditional Sales Contract: Often used in the sale of goods where ownership is transferred only after certain conditions are met, this document, like the Texas Odometer Statement form, provides a detailed record of the sale, including price, description of the sold item, and conditions under which the sale is finalized, ensuring both parties are aware of and agree to the terms.

Dos and Don'ts

When dealing with the Texas Odometer Statement form, accuracy and honesty are critical. Below are essential do's and don'ts to guide you through the process:

- Do ensure that you have the correct form, which is the Odometer Disclosure Statement VTR-40 (Rev. 11/09).

- Do read the instructions carefully before filling out the form to avoid any mistakes.

- Do write legibly, ensuring that all the information provided is clear and easy to read.

- Do verify the vehicle identification number (VIN) on the vehicle matches the VIN on the form to ensure the correct vehicle information is being reported.

- Do check the appropriate box indicating if the mileage stated is in excess of its mechanical limits or if the odometer reading is not the actual mileage, should these situations apply.

- Don't leave any sections blank. If a section does not apply, consider marking it as "N/A" (not applicable).

- Don't use this form for title transfer documents that comply with federal and state odometer disclosure requirements for Texas Certificates of Titles issued on or after April 29, 1990, as it's not compliant.

- Don't provide any false information. Both the Federal and State Law highlight that inaccuracies or omissions can lead to fines and/or imprisonment.

- Don't forget to have both the seller/agent and buyer/agent sign and date the form to acknowledge the odometer disclosure.

Following these guidelines will help ensure the process is completed correctly and legally, avoiding any potential legal consequences. The weight of this document in the sale and purchase of a vehicle presents the necessity for diligence and accuracy from both parties.

Misconceptions

Understanding the Texas Odometer Statement form is critical for both buyers and sellers of vehicles in Texas. However, there are several misconceptions about this form and its requirements. Addressing these misconceptions can help ensure compliance with federal and state laws and avoid potential penalties.

Misconception 1: The Texas Odometer Statement form is optional. In reality, federal and state law mandate the disclosure of mileage during a vehicle's ownership transfer. Not completing the form or providing false information can lead to fines or imprisonment.

Misconception 2: Any title transfer document can be used in place of the Texas Odometer Statement form. However, this form must not be used with title transfer documents that already comply with odometer disclosure requirements, especially for vehicles with titles issued after April 29, 1990.

Misconception 3: Digital odometer readings with tenths of miles can be reported. The form specifically requires the odometer reading without tenths to ensure consistency and clarity in the reporting process.

Misconception 4: It's only necessary to fill out the form when the vehicle has a clear mileage. The form accommodates circumstances where the actual mileage of the vehicle is not known or exceeds its mechanical limits, thus ensuring transparency in all situations.

Misconception 5: Only individual owners need to complete the odometer statement. In fact, if a vehicle is titled in the name of a firm, the firm's name must be clearly printed on the form, emphasizing that businesses must also comply with odometer disclosure laws.

Misconception 6: The buyer's acknowledgment of the odometer disclosure is not crucial. Contrary to this belief, the form requires a section to be completed by the buyer/agent, acknowledging the odometer certification provided by the seller/agent, which is a critical step in the process.

Misconception 7: Odometer discrepancies don't have serious consequences. The form clearly warns of potential odometer discrepancies, indicating the seriousness of providing accurate information due to the legal implications, including the risk of felony charges for falsifying information.

Misconception 8: The form only needs to be completed at the time of sale. While it is primarily used during the transfer of ownership, understanding its requirements is important for both the seller and the buyer before the sale, to ensure all obligations are known and followed.

Misconception 9: Personal information is not necessary on the form. The form requires detailed contact information for both the seller/agent and the buyer/agent, highlighting the need for accountability in the odometer disclosure process.

Misconception 10: A dealer is not required to provide an odometer statement for new vehicles. Regardless of whether a vehicle is new or used, odometer disclosure is a legal requirement, ensuring that every vehicle's mileage is accurately reported and acknowledged during the transfer of ownership.

By addressing these common misconceptions, individuals and firms can better navigate the process of buying or selling a vehicle in Texas. Accurate completion of the Texas Odometer Statement form not only complies with legal standards but also protects the interests of all parties involved in the transaction.

Key takeaways

When dealing with the Texas Odometer Statement form, it is crucial for both sellers and buyers to be aware of the following key points:

- Federal and State law mandates the disclosure of a vehicle's mileage upon ownership transfer. Accurately reporting the odometer reading is not just a formality; it is a legal requirement designed to protect both parties in the transaction.

- Failure to complete the Odometer Disclosure Statement (Form VTR-40) or providing false information can lead to severe penalties, including fines and/or imprisonment. This underscores the importance of honesty and accuracy in completing this document.

- This specific form cannot be used alongside title transfer documents that already comply with federal and state odometer disclosure requirements, particularly for Texas Certificate of Titles issued after April 29, 1990. This limitation is crucial for ensuring that the form is used appropriately and in the correct circumstances.

- Sellers must certify to the best of their knowledge that the odometer reading reflects the actual mileage of the vehicle. If the odometer reading does not reflect the actual mileage due to mechanical limits being exceeded or any discrepancy, this must be clearly indicated on the form.

- The form includes a section for the acknowledgment of odometer disclosure by the buyer or the buyer’s agent. This section is vital as it confirms that the buyer is aware of and understands the odometer certification provided by the seller.

- Both the seller and the buyer (or their agents) must provide their signatures, printed names, contact information, and the date of the statement. These details are essential for the validity of the document and ensure that both parties are accountable for the information provided.

- The Texas Transportation Code (§501.155) categorizes falsifying information on the Odometer Disclosure Statement as a third-degree felony. This legal stipulation highlights the seriousness of the document and the information it contains.

In conclusion, when completing the Texas Odometer Statement form, it is paramount for all involved parties to provide accurate and truthful information. This form is a critical component of the vehicle's ownership transfer process, and adherence to the guidelines mentioned above will ensure compliance with legal requirements, helping to avoid potential penalties.

Common PDF Forms

Credit Application Template - Designed for use by companies looking to secure credit facilities from financial institutions or suppliers.

Western Union Receipt Generator - Leverages advanced encryption technology to keep your personal information and financial transactions secure.