Valid Vehicle Repayment Agreement Template

Imagine you're standing at the dealership, keys in hand, ready to drive off in your new car. The excitement is palpable, but so is the reality of the financial commitment you're about to make. Here is where the Vehicle Repayment Agreement form plays a pivotal role, serving as the linchpin between your dream car and the legal and financial responsibilities you undertake to make it truly yours. This crucial document outlines the terms of your loan or financing agreement, detailing the payment schedule, interest rates, penalty for late payments, and the consequences of defaulting on the loan. Beyond serving as a mere contract, it acts as a comprehensive safeguard for both the borrower and the lender, ensuring that all parties are clear on their obligations and the steps that will be taken should any issues arise during the repayment period. The form stands not just as a testament to the transaction, but as a guide, helping navigate the often complex journey of auto financing.

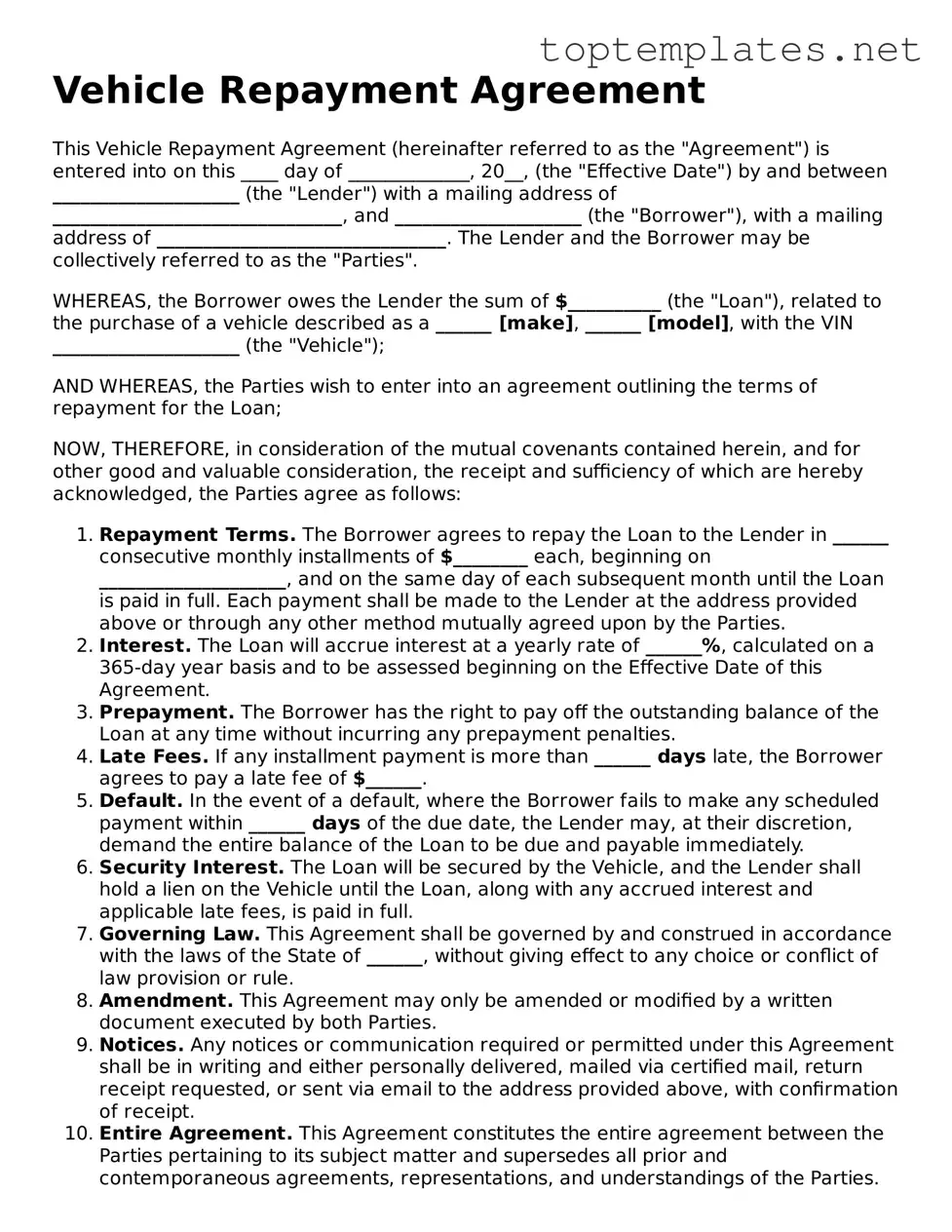

Sample - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement (hereinafter referred to as the "Agreement") is entered into on this ____ day of _____________, 20__, (the "Effective Date") by and between ____________________ (the "Lender") with a mailing address of _______________________________, and ____________________ (the "Borrower"), with a mailing address of _______________________________. The Lender and the Borrower may be collectively referred to as the "Parties".

WHEREAS, the Borrower owes the Lender the sum of $__________ (the "Loan"), related to the purchase of a vehicle described as a ______ [make], ______ [model], with the VIN ____________________ (the "Vehicle");

AND WHEREAS, the Parties wish to enter into an agreement outlining the terms of repayment for the Loan;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Repayment Terms. The Borrower agrees to repay the Loan to the Lender in ______ consecutive monthly installments of $________ each, beginning on ____________________, and on the same day of each subsequent month until the Loan is paid in full. Each payment shall be made to the Lender at the address provided above or through any other method mutually agreed upon by the Parties.

- Interest. The Loan will accrue interest at a yearly rate of ______%, calculated on a 365-day year basis and to be assessed beginning on the Effective Date of this Agreement.

- Prepayment. The Borrower has the right to pay off the outstanding balance of the Loan at any time without incurring any prepayment penalties.

- Late Fees. If any installment payment is more than ______ days late, the Borrower agrees to pay a late fee of $______.

- Default. In the event of a default, where the Borrower fails to make any scheduled payment within ______ days of the due date, the Lender may, at their discretion, demand the entire balance of the Loan to be due and payable immediately.

- Security Interest. The Loan will be secured by the Vehicle, and the Lender shall hold a lien on the Vehicle until the Loan, along with any accrued interest and applicable late fees, is paid in full.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of ______, without giving effect to any choice or conflict of law provision or rule.

- Amendment. This Agreement may only be amended or modified by a written document executed by both Parties.

- Notices. Any notices or communication required or permitted under this Agreement shall be in writing and either personally delivered, mailed via certified mail, return receipt requested, or sent via email to the address provided above, with confirmation of receipt.

- Entire Agreement. This Agreement constitutes the entire agreement between the Parties pertaining to its subject matter and supersedes all prior and contemporaneous agreements, representations, and understandings of the Parties. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other provision, nor shall any waiver constitute a continuing waiver unless otherwise expressly stated.

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the Effective Date first above written.

Lender's Signature: ___________________________________ Date: ____________

Borrower's Signature: _________________________________ Date: ____________

File Breakdown

| Fact | Description |

|---|---|

| Definition | A Vehicle Repayment Agreement is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. |

| Components | The agreement typically includes details such as the loan amount, interest rate, repayment schedule, collateral (usually the vehicle itself), and the rights and obligations of both the lender and the borrower. |

| Governing Laws | This type of agreement is governed by the state's laws where it was executed or where the vehicle is purchased. State-specific laws may dictate certain terms, disclosures, and rights related to the agreement. |

| Important for Both Parties | It provides the lender with a measure of security that the loan will be repaid, while it offers the borrower a clear understanding of what is expected in terms of repayment, including any penalties for late payments or defaults. |

| Default Consequences | If the borrower defaults on their payments, the agreement gives the lender the right to repossess the vehicle, which is the collateral for the loan, and may allow for additional legal actions to recover the outstanding debt. |

| Modification and Termination | The agreement can be modified or terminated early if both parties agree to the changes in writing. Any modifications should be documented carefully to avoid future disputes. |

Steps to Filling Out Vehicle Repayment Agreement

When you're ready to set up a payment arrangement for a vehicle, filling out the Vehicle Repayment Agreement is a necessary step. This document outlines the terms of your agreement, including payment amounts, due dates, and any other conditions both parties have agreed to. Correctly completing this form ensures that all details of the payment arrangement are legally documented, providing peace of mind for both the lender and borrower. Below you'll find straightforward steps to fill out the Vehicle Repayment Agreement form accurately.

- Start by entering the date at the top of the form. This should be the date on which the agreement is being made.

- Fill in the names and addresses of both the borrower and the lender in the designated sections. Make sure this information is accurate to avoid any confusion.

- Specify the vehicle details, including make, model, year, color, and Vehicle Identification Number (VIN), in the section provided. This ensures the exact vehicle subject to the agreement is correctly identified.

- Enter the total loan amount that is being repaid under this agreement. This should include any interest or fees agreed upon by both parties.

- List the payment schedule. Specify the amount of each payment, the frequency of payments (e.g., monthly), and the due date for the first payment and subsequent payments.

- Detail any late payment fees and the conditions under which they apply. This is important to ensure the borrower is aware of the consequences of late payments.

- Include any other terms and conditions that both parties have agreed to. This could involve early repayment options, what happens in case of a default, and any other special conditions related to the repayment agreement.

- Both the borrower and the lender should sign and date the agreement at the bottom. It's also advisable to have witness signatures if required by state laws.

After completing these steps, you'll have a fully-executed Vehicle Repayment Agreement. This document should be kept safe by both parties as it will serve as a legal record of the payment plan. Remember, any changes to this agreement should be made in writing and signed by both parties, to maintain clarity and avoid potential disputes in the future.

Discover More on Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legally binding contract that outlines the repayment terms and conditions for money borrowed to purchase a vehicle. This agreement specifies the loan amount, interest rate, repayment schedule, and the rights and obligations of both the borrower and the lender.

When should I use a Vehicle Repayment Agreement?

Use a Vehicle Repayment Agreement whenever you borrow or lend money for the purchase of a vehicle. This document is essential for setting clear terms and avoiding misunderstandings or legal conflicts between the borrower and the lender.

What are the key components of a Vehicle Repayment Agreement?

Key components include the loan amount, interest rate, repayment schedule, information about the vehicle being purchased (make, model, year), and the signatures of both parties. It may also include provisions on late payment fees, prepayment penalties, and the actions to be taken in case of default.

How can I ensure that my Vehicle Repayment Agreement is legally binding?

To ensure the agreement is legally binding, make sure it is written clearly and includes the full legal names and contact information of the parties involved, precise terms of the loan, and the signatures of both parties. It's also advisable to have the document notarized or witnessed.

Do both the borrower and the lender need to sign the Vehicle Repayment Agreement?

Yes, both the borrower and the lender must sign the agreement. Their signatures formalize the contract, making it enforceable and legally binding.

Can I modify a Vehicle Repayment Agreement after it has been signed?

Modifications to the agreement can be made if both parties consent to the changes. Any amendments should be added in writing, and both the borrower and the lender should sign off on these changes to maintain the document's enforceability.

What happens if the borrower defaults on the loan?

In case of default, the lender has the right to take legal action to recover the outstanding balance. The specific actions that can be taken are usually outlined within the agreement itself, such as vehicle repossession or initiating legal proceedings.

Is a Vehicle Repayment Agreement necessary for transactions between family and friends?

Even for transactions between family and friends, a Vehicle Repayment Agreement is highly recommended. It helps in clarifying the terms and conditions of the loan, thereby avoiding potential disputes or misunderstandings in the future.

Where can I find a template for a Vehicle Repayment Agreement?

Templates for Vehicle Repayment Agreements can be found online through legal services websites. However, to ensure that the document meets specific requirements and is legally sound, consider consulting with a legal professional who can provide a customized agreement tailored to your needs.

Common mistakes

When filling out a Vehicle Repayment Agreement form, attention to detail is crucial. This document sets the terms under which a vehicle is being repaid, making accuracy paramount. Common mistakes can lead to misunderstandings, delays, or even legal complications down the road. Here are six mistakes often encountered:

Not verifying the accuracy of personal information. Both parties’ full names, addresses, and contact information need to be double-checked for correctness. Typos or outdated information can lead to communication issues or misdirected notices.

Skipping details about the vehicle. It's essential to include comprehensive vehicle information: make, model, year, VIN (Vehicle Identification Number), and current mileage. This ensures there is no ambiguity about which vehicle the agreement covers.

Failing to specify payment terms clearly. The agreement must detail the loan amount, interest rate (if any), repayment schedule, and the due date for each payment. Leaving out any of these details can create confusion about the expected payments.

Overlooking late fees and consequences of defaulting. Clearly state any late fees and specify what constitutes defaulting on the loan. This holds all parties accountable and provides a clear course of action if payments are missed.

Forgetting to include the signatures and dates. An agreement is not legally binding without the signatures of both parties and the date signed. This oversight can invalidate the document.

Not specifying jurisdiction. It’s important to state which state’s laws will govern the agreement. Without this, disputes can become significantly more complicated to resolve.

By addressing these common mistakes, individuals can create a solid Vehicle Repayment Agreement that secures the interests of all parties involved.

Documents used along the form

When entering into a vehicle repayment agreement, it's important to be well-prepared with the necessary documentation to ensure a smooth and legally sound process. This agreement forms the core of the financial arrangement between the buyer and the seller (or lender), detailing the repayment schedule for the vehicle in question. Alongside this pivotal document, several other forms and documents are often utilized to provide clarity, legal protection, and comprehensive coverage of all related matters. Below is a description of up to 10 notable documents that are frequently used in conjunction with a vehicle repayment agreement.

- Bill of Sale: This document acts as proof of the transaction, detailing the sale's specifics, including the vehicle's description, purchase price, and date of sale. It serves as a receipt for the buyer.

- Promissory Note: Often used alongside or as part of the vehicle repayment agreement, it outlines the borrower's promise to repay the sum borrowed under specified conditions.

- Loan Agreement: If the vehicle is financed through a loan, this agreement specifies the loan's terms, including interest rates and repayment schedule, between the lender and the borrower.

- Vehicle Title: This legal document denotes the vehicle's ownership. Upon the completion of payments, the seller or lender will transfer the title to the borrower, officially signifying the change of ownership.

- Insurance Documents: Proof of insurance is necessary for the protection of both parties in case of an accident or theft. These documents should be in order before the vehicle repayment process begins.

- Warranty Documents: If applicable, warranty documents provide details about what aspects of the vehicle are covered by the manufacturer or seller and for how long.

- Service Records: These records give a history of the vehicle's maintenance and repairs, offering transparency about its condition and helping establish its value.

- Registration Documents: Legal vehicle operation requires up-to-date registration, demonstrating compliance with state regulations.

- Personal Identification: Valid identification, such as a driver’s license or state ID, is required to confirm the identities of the parties involved in the agreement.

- Credit Report: In some cases, the lender may require a credit report to assess the borrower's creditworthiness before finalizing the vehicle repayment agreement.

Each of these documents plays a vital role in the overall process of arranging a vehicle repayment. They work together to ensure that all parties are well informed of their rights and responsibilities, that the vehicle in question is legally transferred, and that the financial aspects of the transaction are clearly defined and agreed upon. Equipped with the right documents, buyers, sellers, and lenders can navigate the complexities of vehicle repayment agreements with greater assurance and legal security.

Similar forms

Personal Loan Agreement: Similar to a Vehicle Repayment Agreement in that it outlines the terms of a loan between two parties, the amount borrowed, the repayment schedule, and the interest rate, if applicable.

Installment Payment Agreement: This document also shares similarities, as it allows the borrower to pay back an amount owed over a specified period, often with designated installment amounts, just like a Vehicle Repayment Agreement.

Promissory Note: Similar to a Vehicle Repayment Agreement because it is a written promise to pay a certain amount of money to another party under agreed terms, including repayment schedules and interest rates.

Mortgage Agreement: Although this is typically associated with real estate, it's similar to a Vehicle Repayment Agreement in its structure, securing a loan with the property (in this case, a vehicle) and specifying repayment terms.

Lease Agreement: A Lease Agreement shares similarities in terms of specifying payments for the usage of an asset over a period. However, unlike a Vehicle Repayment Agreement, ownership doesn't change hands at the end of the lease term unless a buyout option is exercised.

Rent-to-Own Agreement: This is similar to a Vehicle Repayment Agreement but typically involves property like real estate or consumer goods. It outlines terms where the lessee makes regular payments for the use and eventually the purchase of the item.

Debt Settlement Agreement: Similar in its focus on repaying an agreed-upon amount over time, this agreement usually involves negotiation to lower the overall debt amount between the debtor and creditor, a concept that can be utilized in a Vehicle Repayment Agreement under certain circumstances.

Co-Signer Agreement: Often an adjunct document to loans and repayment agreements, including those for vehicles, wherein an additional party agrees to take responsibility for the loan if the primary borrower fails to make payments.

Credit Card Agreement: Although focused on revolving credit rather than a term loan, it outlines the borrower's responsibilities for repayments, similar to a Vehicle Repayment Agreement in terms of specifying payment terms and conditions.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is important to approach the task with care and attention to detail. Below are essential dos and don'ts to consider during the process.

Do:

- Read through the entire agreement before starting to fill it out, ensuring you understand all the terms and conditions.

- Use black ink or type the information to ensure clarity and prevent misunderstandings.

- Provide accurate and complete information for every field required in the form.

- Check the payment schedule and amounts thoroughly to confirm they match your understanding and agreement.

- Sign and date the form in the designated areas to validate the agreement.

Don't:

- Leave any fields blank; if something does not apply, mark it as "N/A" to indicate you did not overlook the field.

- Use pencil or any erasable writing tool, as this can lead to alterations that may not be legally binding.

- Rush through the form without verifying all the data you've entered, especially numbers and dates.

- Forget to get a copy of the signed agreement for your records, ensuring both parties have proof of the agreement.

- Assume anything; if you have questions or something is unclear, seek clarification before signing the document.

Misconceptions

The Vehicle Repayment Agreement form often generates a pool of misconceptions that can muddle its true intent and effectiveness. Grasping these misunderstandings is crucial for both consumers and marketers to navigate the complexities surrounding vehicle finance agreements. Below, we explore eight common misconceptions.

It's just another name for a loan agreement: Although a Vehicle Repayment Agreement shares similarities with loan agreements, in essence, it specifically outlines the conditions under which a borrower agrees to repay the cost of the vehicle to the lender. It can encompass more detailed conditions tailored to the automotive context, such as insurance requirements and vehicle maintenance obligations.

Signing up means you're immediately approved for financing: Completing a Vehicle Repayment Agreement form does not guarantee financing. It is a step in the process, where the lender will still require to assess the borrower's creditworthiness and other criteria before approval.

Interest rates are non-negotiable: Interest rates on these agreements can often be negotiated. Factors such as credit score, down payment size, and even the vehicle itself can influence the rate offered by the lender.

Default always leads to repossession: While repossession is a possible outcome of default, lenders may offer options for borrowers to catch up on late payments before taking such action. Communication with the lender at the first sign of financial trouble is key.

A longer-term agreement always means lower monthly payments: Although extending the term of the agreement generally lowers monthly payments, it also means more interest paid over the life of the loan. The overall financial impact should be carefully considered.

There's no impact on your credit score if you pay off your agreement early: Paying off a Vehicle Repayment Agreement early can positively impact your credit score by reducing your debt-to-income ratio. However, it's essential to check if there are any penalties for early repayment.

Only the primary borrower’s credit is affected: If there is a co-signer on the agreement, both the primary borrower's and the co-signer's credit scores can be impacted by the account's performance. Both parties should fully understand their responsibilities.

Vehicle modifications are always permitted: Many agreements contain specific clauses about modifications, requiring lender approval before making any changes to the vehicle. Unauthorized modifications can lead to the agreement being terminated.

Understanding the Vehicle Repayment Agreement form in its entirety is vital for those navigating the process of financing a vehicle. Clearing up these misconceptions can lead to better financial decisions and foster a transparent agreement between the lender and borrower. Always consult the agreement thoroughly and seek clarification on any points of confusion before committing.

Key takeaways

Understanding and using the Vehicle Repayment Agreement form is essential for ensuring that both the lender and buyer are on the same page regarding the repayment terms of a vehicle loan. Here are key takeaways to consider:

- Read the form carefully before filling it out. Ensure all sections are understood, as this document legally binds you to its terms.

- Fill out the full names and addresses of both the lender and the borrower clearly to avoid any confusion about the parties involved.

- Specify the vehicle details, including make, model, year, VIN (Vehicle Identification Number), and color, to ensure there's no ambiguity about the vehicle being financed.

- Clearly outline the loan amount being borrowed for the vehicle purchase. This should match the amount agreed upon by both parties.

- Detail the repayment schedule, including the due dates, monthly payment amount, and the total number of payments. This information helps both parties keep track of the repayment progress.

- Include the interest rate, if applicable, to the loan. This should be agreed upon by both the lender and the borrower in advance.

- State the late fee policy. Clarifying the consequences of late payments upfront can help avoid conflicts in the future.

- Add a clause about the prepayment policy, if any. Some agreements allow the borrower to pay off the loan early without penalties, while others may impose a fee.

- Ensure the form includes a section for signatures from both the borrower and the lender, as well as a witness, if required. The document is not legally binding without these signatures.

- Keep a copy of the signed agreement for both the lender’s and borrower’s records. This duplicate can be vital in case of disputes or for record-keeping purposes.

By following these key points, individuals can fill out and use the Vehicle Repayment Agreement form effectively, safeguarding the interests of both the borrower and the lender.

Consider Other Documents

Tattoo Waiver Form - It is essential for confirming the client’s consent for the specific tattoo design, placement on the body, and any other relevant details regarding the tattoo procedure.

Power of Attorney Form California - It's crucial to discuss your wishes with the person you're appointing to ensure they understand your preferences.

USCIS Form I-864 - The I-864 form must be submitted with supporting documents, such as tax transcripts, W-2s, and proof of U.S. citizenship or permanent residency.